Cask whiskey investment leaders, Whiskey & Wealth Club, has reported that cask whiskey’s favourability with investors has strengthened this year. A total of 258.5 pallets of Scotch, Irish and American whisk(e)y have been purchased since lockdown began.

Since the start of the year, €7.8m has been purchased in cask whiskey through Whiskey & Wealth Club, doubling from the same period last year. This comes as traditional financial markets across the world waver amidst the coronavirus pandemic, which has seen the UK economy shrink by a record 20.4%.

Significantly, the investments are strengthening the whiskey industry during this challenging time. Leading distilleries in the UK and Ireland that work with whiskey and wealth club receive an injection of capital. This helps cover overheads for the costly and labour intensive whiskey making process.

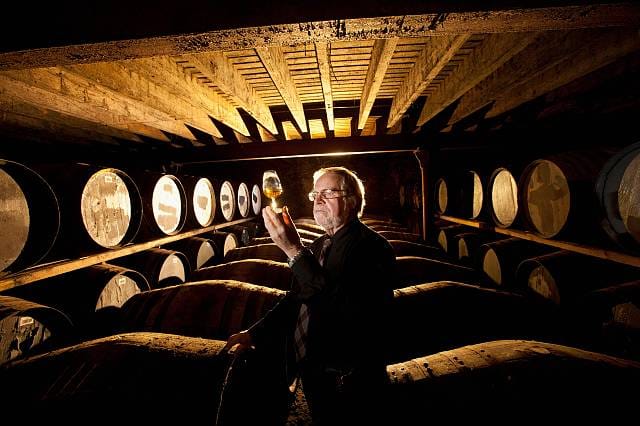

These asset-backed casks purchased as a great buy and hold strategy have become increasingly popular for investors, given the current economic climate. The investment in casks are not tied to financial markets and give investors full ownership and titles to the whiskey which is stored in excise warehouses for the ageing process, typically five to 10-years.

The popularity of whisk(e)y investment has soared in recent years. This year, rare whisky topped the Knight Frank luxury investments index, rising by 564% in value over the last decade. Recent research by Whiskey & Wealth Club found that 55% of investors would consider investing in cask whiskey.

Currently, the Scottish whisky secondary wholesale market is estimated at $40m according to the IWSR, the global benchmark for wine and spirit data. Last year alone, exports grew to a record £4.9bn. Irish whiskey is also amid a resurgence. Exports have grown by 300% in the past decade, with the US market worth $1bn alone.

Headquartered in Richmond in the UK with a satellite office in Dublin, Ireland, Whiskey & Wealth Club gives investors the opportunity to purchase casks of premium Scotch, Irish and American whisk(e)y direct from leading distillers at ultra-wholesale rates.

Whiskey & Wealth Club was recently commended for business excellence at the prestigious UK Business Awards. The company claimed four accolades during the virtual ceremony highlighting its success in only its third year, despite the current challenging economic climate.

CEO and co-founder at Whiskey & Wealth Club, Scott Sciberras, said: “Despite the current predicament of global financial markets, cask whiskey investment bucks the trend. We’ve seen it go from strength to strength as it grows in favour with investors, which crucially is also supporting distilleries at this testing time.

“The value of these premium spirits is largely determined by age, but also by the quality of the distillery and the brands they release. While all whisky increases in value over time, some increase more than others. So working on an exclusive basis with leading distilleries really gives a strong value add to our clients. Combine this with the fact that cask whiskey is an asset based-investment not tied to financial markets makes it ever-appealing. With expected returns ranging depending on the length of the investment, we estimate conservative returns at 16.1% p/a or an annualized ROI at 10.11% p/a

“This is based on a purchase price of £12,600 per pallet of whisky. A pallet contains 6 casks, therefore a cask price is £2,100. Using today’s exit price for 10 year old non branded single malt Scottish whisky at £33,000. The total ROI is 161.90% over 10-years.

“Your investment gain is £20,400 on top of your initial £12,600, which looks on the surface to be 16.1%, and most would present as such, but professional investors tend to use annualized ROI to help compare against shorter term investments.

“Given the 10-year hold time and compounding, this equates to an annualized ROI of 10.11% per annum. The good news is we do not sell non branded whisky which has the lowest exit price. We sell branded from premium distillers.

“To give you an exit price is speculative as there is many more exit options for branded whiskey over non branded. My highly trained team can explain best for those wanting more information. But as you can see, it’s little surprise that whisky is currently liquid gold to investors.”

Whiskey & Wealth Club offers both private investors and funds the opportunity to purchase premium Single Malt and Single Pot Still cask whiskey at ultra-wholesale prices from leading distilleries. The casks are then stored in a secure bonded warehouse to mature for at least five years, before selling for a profit or bottling.

Leave a Comment