A report on the government’s Bounce Back Loan Scheme (BBLS) reveals a fraud estimate of 11.1% – a loss of £4.9bn.

Real Business Rescue the UK’s largest insolvency practitioner helping to advise distressed businesses – surveyed 50+ insolvency practitioners who have handled thousands of director-led liquidations in the last 12 months to uncover the ways business owners and stakeholders have misused COVID-19 loans, including the Bounce Back Loan Scheme and the Coronavirus Business Interruption Loan Scheme.

Shaun Barton, National Online Business Operations Director at Real Business Rescue, said, “Coronavirus Business Interruption Loan Schemes and Bounce Back Loan Schemes have played a pivotal role in helping businesses stay afloat these past two years.

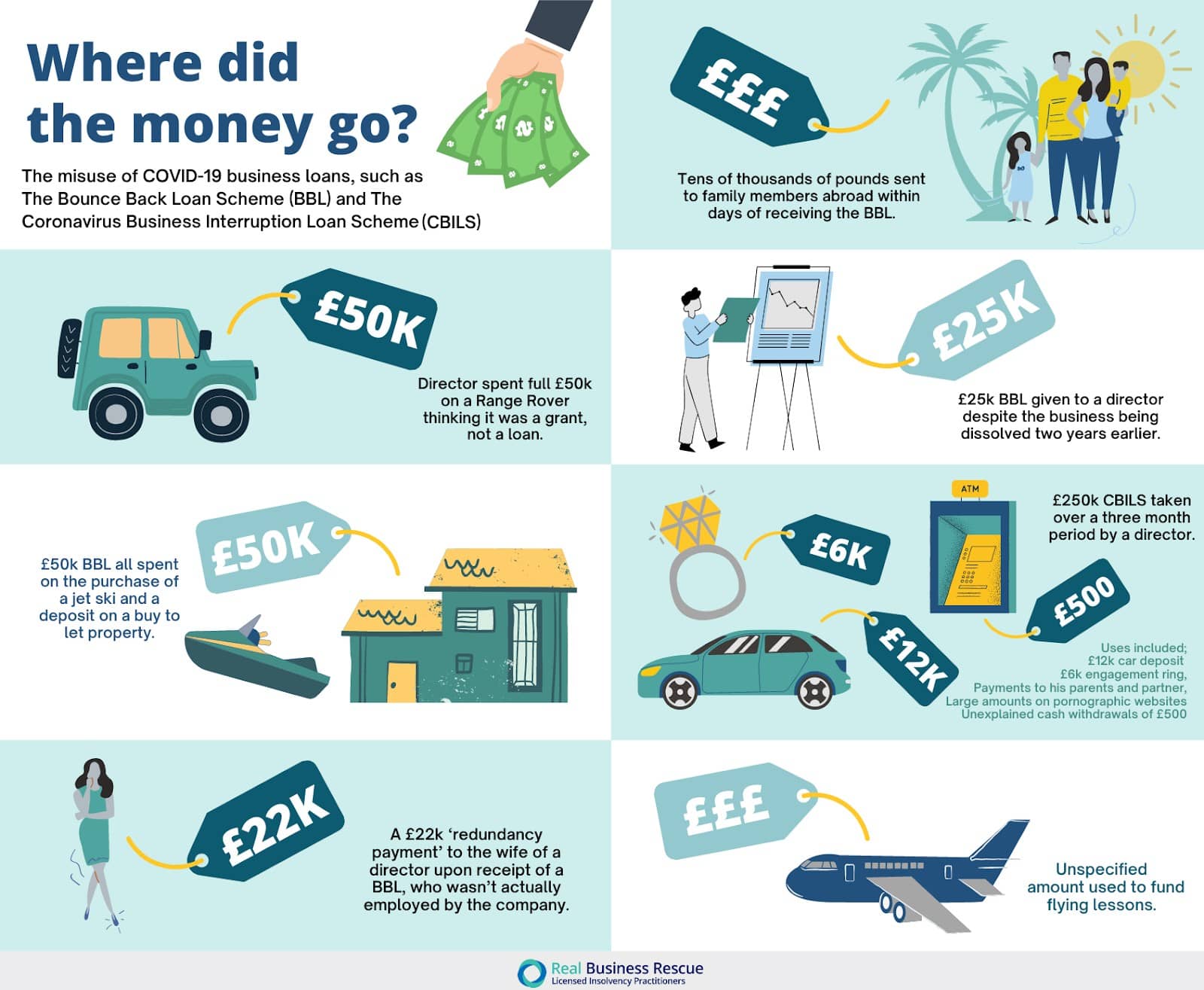

“However, whilst the majority were taken out in good faith to help withstand the effects of the pandemic, our investigation shows that – sadly – in some cases, these loans designed to keep businesses going, and people employed, have been grossly misused.

“Examples of these include directors using the schemes to send bonuses and payments to themselves in addition to non-employees like friends and family, put down deposits on houses, take flying lessons, buy luxury items such as new £50k cars, engagement rings, and jet skis, and even spending thousands on pornographic sites.

“Examples of these include directors using the schemes to send bonuses and payments to themselves in addition to non-employees like friends and family, put down deposits on houses, take flying lessons, buy luxury items such as new £50k cars, engagement rings, and jet skis, and even spending thousands on pornographic sites.

“At a time where so many businesses are genuinely struggling, and the rising cost of living continues to cause concern for people up and down the country, it is shocking to see billions of pounds in taxpayers’ money lost in the abyss of misuse, negligence, and fraud.

“In our role of advising businesses in distress, we don’t condone this misconduct in any way. If a liquidator uncovers fraud or misuse of Bounce Back Loans or the CBILS, they will look to recover the loan from the director – if they are found to be a breach – by way of misfeasance action. The director would potentially face a heavy fine and a possible disqualification from the Insolvency Service.”

Leave a Comment