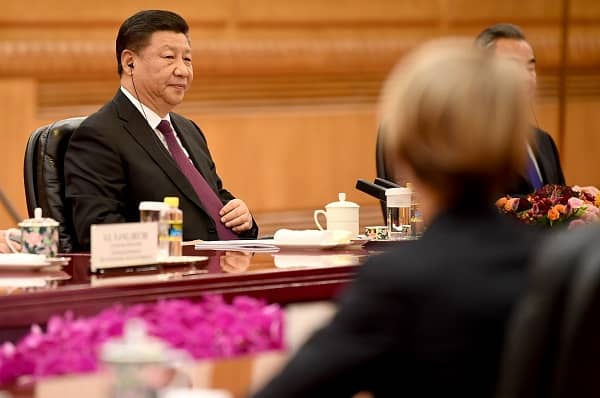

Chinese stocks retreated on October 24, following data emerging on the health of the Chinese economy, as well as moves by President Xi to secure a third term, which was first reported on Finbold.

Reportedly Chinese banks have been ordered to purchase shares in an effort to prevent further selling pressure and possibly stabilize Shanghai stock indexes.

Given the recent weak performance of the economy, the move appears to have the goal of bringing about stabilization in the local market.

The deprecation of the yuan currency reached its lowest point since 2007. China’s currency lost 13% of its value year-to-date (YTD), with mainland markets facing more selling pressure from foreign financial institutions.

As reported earlier by Finbold, on October 21, the People’s Bank of China (PBOC) set the midpoint rate at 7.1186 per dollar in an attempt to cap the downside of the yuan.

Treacherous markets

However, on October 25, a slight pause in the sell-off was noted, as the Hang Seng China Enterprises Index (INDEXHANGSENG: HSCEI) gained 1.3% after losing 7.3% in the previous session.

Following the rout in Chinese stocks and the fact that president Xi’s third term is now secure and more zero-Covid policies could be expected, Hao Hong, partner and chief economist at Grow Investment Group, underlined that “the market remains undecided, and selling pressure remains.”

Furthermore, Andy Wong, a fund manager at LW Asset Management Advisors Ltd, advised investors to take a “wait and see” approach when it comes to investment in Chinese stocks.

Wong said, “Although there may be some rebound, the short-term risk and reward ratio is not attractive. At this moment, I believe wait and watch is a better way to deal with the market.”

Wait and see

It has been claimed that China is giving orders to its state banks to buy equities in an effort to stem the tide of excessive selling.

However, if the government’s lockdowns in major Chinese cities continue and more pressure is exerted on China’s sprawling tech sector, then investors should not expect a quick and easy rebound in Chinese stocks.

As the analysts suggest, taking a “wait and see” approach at this moment could be the best bet for investors looking to buy Chinese stocks.

Leave a Comment