Remember the trader who told the BBC that “Goldman Sachs rules the world”? This is his column

Our columnist Alessio Rastani is the self-proclaimed trader who shocked the world by declaring live on BBC News that he goes to bed “every night dreaming of the next recession” and that “Goldman Sachs, not the governments, rule the world”. He’s a controversial figure, not least because he’s a self-taught non-institutional trader with no FSA license. But he certainly isn’t shy about sharing his views. Do you agree with his words? (His words are his own, and in no way endorsed by LondonlovesBusiness.com)

Let me be frank with you. I am not interested in hearing the same old arguments about “market manipulation” and “the Fed” and governments suppressing this and doing that. Blah blah blah.

These arguments have been hammered out for over 20 years. They are definitely not new. If conspiracy theories and politics excite you, good luck with that. Skip this article and move on.

The only thing I am interested in is making money and minimising risk. Period.

It is for this reason that I have refused to be a convert into the “Bitcoin messiah” – the pathological admiration for this so-called “currency” that has gripped many people.

Jeff Reeves of MarketWatch recently said of Bitcoin :

“Bitcoins are not currency — simply a fad scrip for conspiracy theorists who don’t trust governments but somehow don’t fear “money” that exists only as bits on their smartphone.”

I couldn’t agree more. Life as a trader and investor teaches you a few hard lessons about risk and how much you can lose if you’re not prepared.

Unfortunately many of the folks obsessed with Bitcoin care very little about the risks but more about the potential rewards (and the political agenda).

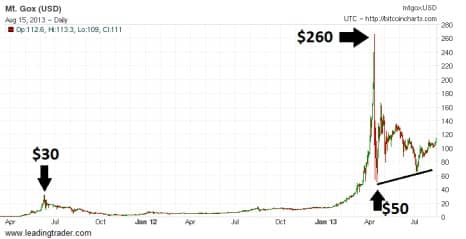

Bitcoin enjoyed a meteoric rise last spring when it jumped from $30 to just over $260. I wonder if there would have been such excitement about Bitcoin if it had stayed stuck at $30 – I doubt it.

Of course, the party didn’t last for very long as it plummeted from $260 to $50 very soon afterwards. Many believe the worst is over for Bitcoin – I disagree.

I believe that by the end of this year Bitcoin enthusiasts are in store for a rude awakening. The way I see it, the “bubble” has burst but the worse is yet to come.

Yes, and I do mean “bubble”! Despite its 1200% surge in three months with its trademark hyperbolic pattern (see chart below) there are some incredibly deluded people who refuse to accept that Bitcoin was a bubble.

As you can see from the above chart, Bitcoin has been consolidating sideways in between $140 and $70 since May.

A break below the July lows should send it hurtling down to reality. I wouldn’t be surprised to see the April $50 lows being re-tested.

With the continuing uncertainty surrounding its status and the fact that it is being used as “a virtual Wild West for narcotraffickers and other criminals,” I don’t see much longevity for this pseudo-currency.

Ultimately I believe that in 2014 we shall see Bitcoin trading near its June 2011 highs of $30 again.

There are also fundamental unanswered questions about the supply of Bitcoin . What is to stop someone else bringing out their own substitute to Bitcoin or alternative “better” versions?

What should make you suspicious about Bitcoin is that its most avid supporters have also a deep political agenda.

In an article “Fool’s Gold – Bitcoin is a Ponzi scheme” Eric Posner wrote:

“Bitcoin unites futuristic left-wing Internet anarchism—the fantasy that the Web can provide the conditions for a governmentless society—with the cave-dwelling right-wing libertarianism of goldbugs who think a stable money supply can be established without government involvement.”

Enough said.

Alessio Rastani gained fame and caused controversy last year by stating live on BBC news that he “dreams of another recession” and that “Goldman Sachs, not governments, rule

the world”. The YouTube clip has since been watched over two million times, and Alessio has subsequently been interviewed by figures such as Sir David Frost. His website is LeadingTrader.com.

- Try our free newsletter

- The LondonlovesTalent Awards: ENTRIES NOW OPEN

More like this:

Alessio Rastani: What you can learn from the Bitcoin bubble

Meet “Bitcoin Jesus” Roger Ver, the millionaire who distributes free Bitcoin s

Kerching! Five Bitcoin millionaires you need to know about

How 23-year-old Charlie Shrem became a millionaire through Bitcoin

Try our free newsletter

Leave a Comment