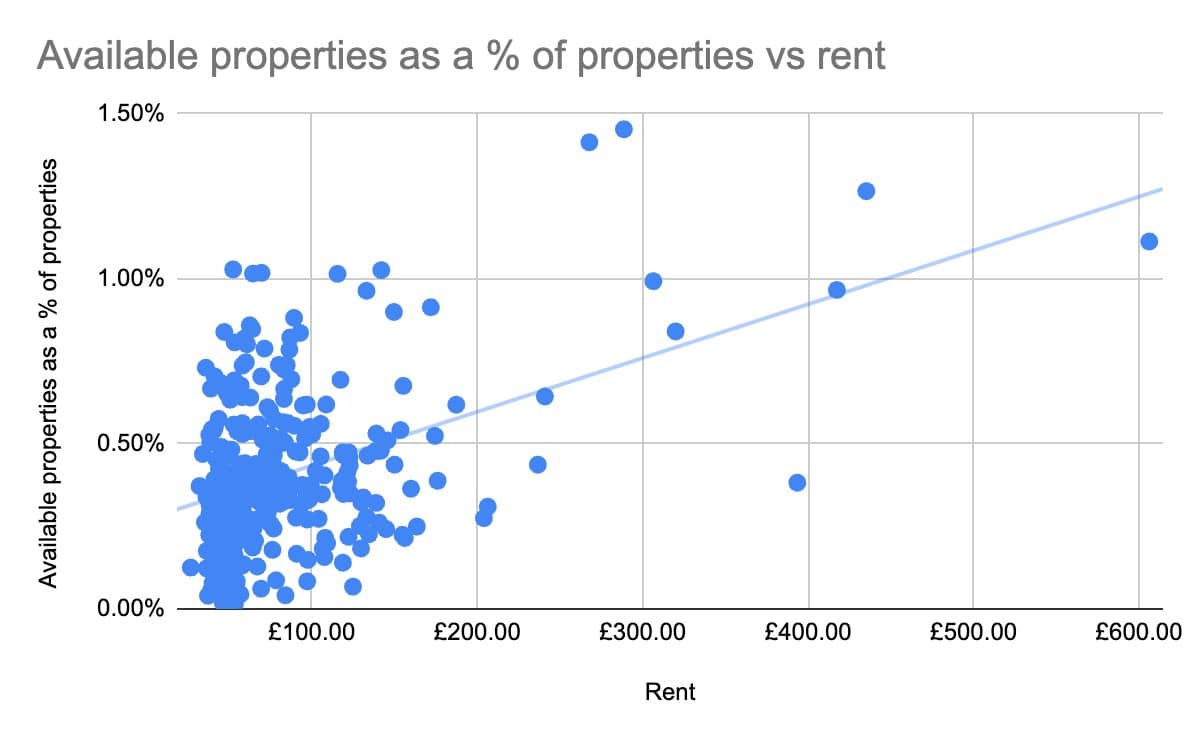

Money.co.uk business loans experts’ research revealed that generally, the areas with the lowest rents have the least number of properties available. This reinforces the notion that rents are something businesses consider a priority when deciding where to base themselves.

The graph below shows that as rent increases, so does the amount of available properties.

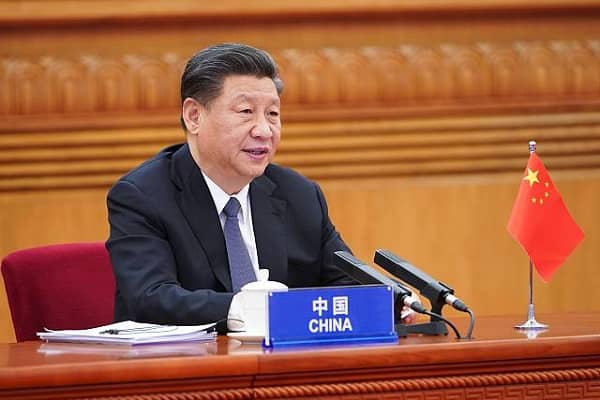

Cameron Jaques, money.co.uk business loans expert, comments on how important it is for small business owners to factor increasing rates into their long-term plans.

Cameron Jaques, money.co.uk business loans expert, comments on how important it is for small business owners to factor increasing rates into their long-term plans.

Jacques said, “With the business rates rise on the horizon of the coming year, small business owners might find the impact is multifaceted. Small businesses often operate on tight budgets, so an increase in business rates can strain their finances, leading to reduced profits or even financial losses.

“Higher operating costs due to increased business rates may also make it harder for small businesses to compete with larger corporations. They may struggle to offer competitive prices or invest in growth initiatives.

“Finally, as business rates are typically paid annually or semi-annually, small businesses might experience cash flow issues when they have to set aside a significant amount of money to cover the increased rates.

“Relocating your business to an area with lower rates can be disruptive and costly in the short term, as it involves moving personnel, equipment, and potentially establishing new customer relationships. However, if it mitigates the aforementioned problems concerning cash flow and profit, it might be worth considering.”

Leave a Comment