Peer-to-peer real estate investment platform, easyMoney, has analysed 13 regal investment assets fit for a King to see which has performed best over the past ten years.

Today, even the amateur investor is able to invest into the finer things in life, asset classes that were traditionally reserved for royalty and high society. From whisky and gold, to jewellery, antique furniture, and real estate, easyMoney has looked at which of these assets have proven to make for the best investments over the past ten years.

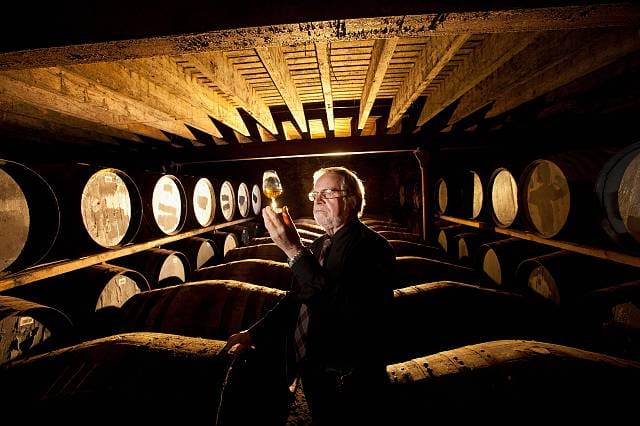

The top performing investment asset is whisky, some of the finest of which hails from the Royal Family’s beloved Scotland. Over the past decade, the value of whisky investments has increased by a staggering 373%.

Classic cars, such as our future King’s beloved Aston Martin which, it is claimed, runs off cheese and wine waste to reduce its carbon footprint, have increased in value by 185% in ten years, while fine wines have soared by 162%.

High-end watches have produced a 147% ten-year return while art (91%) and luxury handbags (74%) have also performed well.

UK property investment returns have increased by 71% over the decade, while London property exclusively has risen by 70%.

Rare coins have increased by 59%, while gold (48%) and jewellery (44%) follow closely behind.

Vintage furniture has delivered ten-year returns of 34%, while coloured diamonds – a variety of which will be on display during this weekend’s coronation – have delivered a return of 16%.

Jason Ferrando, CEO of easyMoney said, “For those who can afford it, luxury product investments have delivered some very strong returns, but these returns are limited to the small proportion of investors who can afford to make big ticket investments.

But for us mere mortals, getting involved with these types of investments can be more complicated than it seems. First of all, you need hefty amounts of cash to make the initial purchases, but you also need a deep level of knowledge about your chosen asset.

If you’re not a genuine expert in watches, whiskeys, or fine art, it’s almost impossible to make an astute decision about what specifically to invest in. And making the wrong decision can be financially catastrophic.

Property investment, on the other hand, is far more accessible to the amateur investor, particularly with the advent of peer-to-peer lending platforms such as easyMoney, enabling investments from as little as £100.”

Leave a Comment