Otherwise known as a contract for difference, a CFD trade is one of the most popular and efficient ways to leverage the movements associated with a specific underlying asset. As with any form of investment, appreciating the mechanics behind this category is paramount if you wish to enjoy success in the future. What are the principles behind a CFD trade, what are the associated benefits and perhaps most importantly, how can CMC Markets provide you with clarity and cutting-edge trading possibilities?

The theory behind CFD trades

A contract for difference (CFDs) is a type of derivative trading considered to be more flexible when compared to standard methods. As opposed to traditional positions, it is possible for the investor to speculate on rising as well as falling prices of a specific asset. This is why such positions are often advantageous during bearish market conditions. One of the main principles behind a CFD trade is that the investor does not purchase or liquidate the asset in question. Rather, he or she will become involved with a discrete number of units. Assuming that the predicted value moves in the correct direction, the investor will enjoy an ROI that is equal to the number of units that were initially purchased in relation to the profit margin.

How to enact such a position

Assuming that the correct asset has been selected, the investor is required to account for the spread; otherwise known as the disparity between the buy and sell prices. Other issues such as holding costs will need to be addressed and these are associated with the length of the contract as well as the movement of the underlying asset at the end of each trading day. Finally, it is possible to execute margin CFD trades. These enable the investor to allocate only a portion of the total value of the underlying asset. The theory is that margin positions will provide exponentially higher profits (assuming that the directional movement is predicted correctly). However, a negative outcome could result in losses that far exceed the initial investment. This is why margin trades should be approached with an air of caution.

The associated benefits

As mentioned previously, the investor is able to speculate on both rising and falling prices; ideal during volatile market conditions. There are nonetheless some other advantages that should never be overlooked. A handful of the most interesting include:

● CFD trades are exempt from Stamp Duty (no physical transactions are taking place).

● It is possible to choose from a wide range of assets.

● Margin trades can provide substantial returns.

● CFDs are considered to be extremely liquid positions.

● These positions are not associated with a predetermined expiration date.

It is clear to see why a growing number of investors are choosing to leverage the power of these instruments.

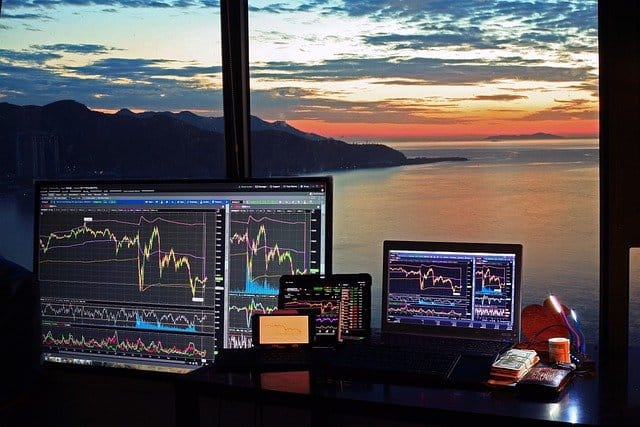

The tools of the trade

While only open to the privileged few in the past, novices can now access CFD trades within seconds thanks to the flexible nature of the CMC Markets trading platform. As always, it is important to understand the mechanics behind any CFD position in order to properly utilise the tools and utilities offered by this trading platform. In terms of agility, few approaches come close to contracts for difference.

Leave a Comment