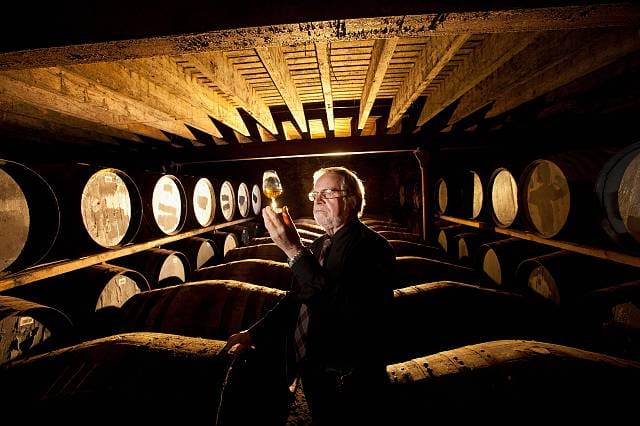

Jay Bradley, Founder of The Craft Irish Whiskey Co explores the turbulent history and enduring appeal of Irish whiskey… and examines why demand is soaring.

Irish whiskey is now the fastest growing spirit globally. In fact, it’s been growing by over 13% year on year since 1990. And since 2009, global exports of Irish whiskey have increased by 300%, according to the Irish food board.

As demand soars so too does the number of companies making and selling it. A mere six years ago there were just four distilleries making and selling Irish whiskey in Ireland. By August 2017, there were 18, and today there are 25 according to the latest figures from the Irish Whiskey Association (IWA) – a clear sign of an industry in resurgence and a market that is clawing its way back from near extinction.

This is the Irish whiskey revolution, and it’s standing right up against the Japanese, Scotch and American whisky markets.

A brief history of the Irish whiskey market

Irish whiskey is back in demand, but it’s fair to say that it’s had a turbulent history. In the 12th century, it was one of the first distilled drinks in Europe, and while we know it was still being made, the records are sparse for the next 200 years. The first recorded mention is in a document dated 1405 in the Annals of Clonmacnoise. This was 89 years before the first mention in Scotland in 1494. We also know that prior to this period the Irish ruled the Inner Hebrides known as Dalriada. The Inner Hebrides is where popular whisky regions lay such as Islay, Campbelltown and Jura and their main form of tourism is whisky. Some historians agree that the Irish monks invented whisky distillation using malted barley and brought it up to its northern province being Dalriada, now known as the Inner Hebrides, Scotland.

Whisky – the “water of life”

Whisky comes from the Latin word Aqua Vitae, meaning water of life. In Gaelic this is translated to Uisce Beatha (pronounced Ishka Ba-ha). It was later shortened to Fuisce (pronounced Fwishka) and eventually to whiska.

Between the 17th and 20th centuries, more than 75% of the whisky bought and consumed globally was Irish whiskey. And before the first world war, whiskey was actually Ireland’s primary export, with most of it enjoyed in the United States.

Ireland industrialized whiskey, specifically Dublin. They built large scale operations and perfected the distillation techniques still used today. Doing this ensured they made a higher quality, consistent product, and removed the majority of fusel oils that made people ill, blind or even caused death. The rest of the world was more akin to what people would imagine as moonshiners in the hills of Kentucky. Making whiskey unregulated so to speak. Dublin whiskey at this time was seen globally as the gold standard. So much so, Scotland and England would fraudulently send their whiskey to Dublin customs warehouses, get a Dublin customs stamp and then send the whisky back to the UK and America and sell for the Dublin whiskey premium price. This hurt Irish whiskey’s reputation as the quality wasn’t the same as the major Dublin distilleries, which had perfected the consistent high-quality spirit.

Then along came the blended cheaper Scottish whisky. This was basically like taking 10% of real malted (but very young) whisky and adding 90% of a neutral grain spirit to make a far cheaper bottle of whisky. Doing this made a lighter drinking spirit that many argued wasn’t real whiskey. However, for many pallets this was easier to drink and mix into cocktails as it was cheaper. Much like taking a glass of single malt and adding some water to smooth out the edges and bring the alcohol burn down that I myself and many whiskey drinks do,, they added a flavourless spirit, (similar to vodka) to keep the ABV above the legal requirement. It essentially made a young 3-year-old malt more palatable rather than having to wait for the real premium malt to age for 10+ years like it should. So, they figured out how to skip the “Father Time” wait period and cut pure quality whiskey with cheaper neutral spirit. The Irish distillers refused to cut their whiskey as it was seen as the ‘Champagne’ of sparkling wine. The premium gold standard. The Dublin distilleries needed to let the public know the difference in the cheaper blended whiskey versus the premium whiskey they made, and so John Jameson III along with 3 other large whiskey houses being Roe & Co, William Jameson and John Powers wrote a book called Truths About Whisky to alert the public to the ‘fraud’ in the industry. And for a short while this gave the Irish back some of the market they were losing to its cheaper blended Scottish counterpart.

But then disaster hit…

Whiskey and war

In 1914, barley was rerouted to feed soldiers and it became too dangerous for export ships as German U-Boats surrounded Britain and Ireland. Many Irish distilleries went bankrupt over this turbulent time.

Then, the Irish war for independence with the crown or the Anglo-Irish War made times difficult for distilleries. Trade tariffs put in place hurt Irish whiskey exports. During the war, some distilleries such as Roe & Co and William Jameson’s were taken over by rebel forces. Heavy gunfire and fighting destroyed some of these distilleries.

And just as that passed, with the Anglo-Irish treaty in 1921, further disaster hit Irish whiskey by losing a huge export market being the US due to Prohibition. Then, in 1932, Ireland had a trade war with Britain which saw a total lock out for Irish exports to Commonwealth countries. This crippled the Irish economy. So, by the Second World War in 1939, Irish whiskey production had plummeted – from 12 million cases a year to a tiny 100,000. Which, per capita 12 million cases, is actually a larger production volume that Scottish whisky enjoys today.

Just four distilleries survived this whiskey market bloodbath, which were Cork Distillers, Bushmills, Powers and probably the best-known outside of Ireland, John Jameson. For many years they all stayed small, fighting over the local customers, afraid to go global. In 1966, three of these merged to form the Irish Distillers Limited (IDL), with the fourth (Bushmills) also joining in 1972. From here on out a monopoly was held on Irish whiskey. Most of which was still only sold locally. Very little was exported, while conversely Scottish whisky was taking over the global market Irish whiskey once held. With over 100 distilleries all working independently Scotland had a thriving whisky industry. This allowed many entrepreneurs to innovate, expand and make great returns, while Ireland’s market merged into one company with no competitors, so innovation didn’t happen, expansion wasn’t needed. We stayed small.

Blended Irish whiskey enters the market

But one thing that did change was in 1966 when this newly formed company IDL did exactly what their forefathers never wanted to happen to Irish whiskey in their manifesto the Truths About Whisky, which was to make a blended cheaper whiskey.

Jameson that today sits on every bar shelf internationally was born in 1966. It wasn’t what they produced in the 1800s that made them the gold standard. Back then it was pure pot still whiskey. But Jameson today is bottled with only a fraction of the pure pot still, followed by a heavy dose of the neutral grain spirit, now known today as “grain whiskey”. It was a copycat blend like was done in Scotland. They did the same to their Bushmills brand, and their Tullamore DEW brand too. Made them all cheaper blends. Only a handful of brands like Redbreast survived as pure pot still like it was back in the 1800s. Is it any wonder why Redbreast wins so many global whiskey awards?

The modern Irish whiskey market – a global player

By the late 1980s, Irish whiskey was very much an underdog in the spirits market, with sales barely scraping 2 million cases a year. Half remained in Ireland, with the rest going to Irish themed pubs in different countries. For a comparison, at the same time, Scotch whisky was selling around 100 million cases globally every year. Due to lack of innovation and competition in the Irish whiskey market, we had fallen to barley 2% of our Scottish counterparts. Irish whiskey was only sold into 27 cities in the US at this time, while Scottish whisky was sold into all 285 cities.

The monopoly on Irish whiskey remained largely with IDL for almost three decades, until the independent Cooley Distillery opened in Dundalk in 1987. The next year, French drinks conglomerate Pernod Ricard bought IDL and all of its brands, and this is what really marks the start of a new surge of investment and interest in the Irish whiskey market. Pernod expanded aggressively into all US markets with Jameson as their ‘golden child’. Bushmills, which competed with Jameson, was sold to Diageo in 2005.

Then, in 2012 Beam-Suntory bought the Cooley Distillery, the global Tequila giant Jose Cuervo acquired Bushmills from Diageo and Bacardi bought a stake in the Teeling Whiskey Company, based in Dublin. This investment from key global drinks conglomerates powered the whiskey market into becoming a global player once again.

And by 2018, more than 10 million cases of Irish whiskey were being sold globally, which is a 500% increase on the 1980s. Exports of Irish whiskey increased in value to 623 million Euros as the industry began delivering premium brands around the world.

Key markets around the world for Irish whiskey

Jameson is now the fourth highest selling whiskey in the world and, if the current figures hold, by 2024 sales of Irish whiskey will reach 23 million cases. So where is it all going? The US is still the biggest market for Irish whiskey by a long shot. In 2017, 44% of the total output from Ireland went to the States – that’s 4.1 million cases. Ireland itself comes next with 6.5% of the market share, which is 600,000 cases.

This new demand for Irish whiskey is brilliant news for the sector. It gives us scope to create new single malt whiskeys, single pot still whiskeys, premium brands, ultra-premium brands and unite to bring consumers more choice. As they say ‘a rising tide lifts all ships’ and with all these new entrepreneurs coming in, it won’t be long until the innovation and expansion these new players bring in to Irish whiskey starts to show.

There’s nothing to stop its popularity matching or rivalling the Scottish and American whiskies, by turning our attention to new demographics such as the luxury sector like The Macallan and The Dalmore have done so well in, while and boosting choices available.

Other key expansion markets for Irish whiskey around the world right now include the rest of the UK, South Africa, Germany, France and Russia. In 2017, each of these countries bought around 400,000 cases, together totalling 20% of the market. And while France flatlined, all other export markets grew in 2017 and 2018, with UK sales up 12.5% and Russian by just under 20%.

What makes Irish whiskey different?

It’s all in the process. Irish whiskey is exclusive. Other major whisky markets, such as Japanese, can use blends from different countries to create the final product. Irish whiskey, by law, can only be distilled and matured in Ireland itself. This amps up the premium nature of the product.

Our burgeoning industry really works together to protect and promote the reputation of this beloved export. We were absolutely thrilled when, in 2019, the European Commission approved Irish whiskey as a geographical indication (GI). This was following the submission of the Irish whiskey technical file by the industry and the Department of Agriculture, Food and Marine. It set out detailed different types (malt, pot still, grain and blended) and the production techniques, in accordance with the 2008 EU Spirit Regulation.

Receiving the GI accreditation is a significant milestone for the Irish whiskey industry and will ensure protection across the category. It helps to crack down on the fakes that try to infiltrate the market and global consumers to see past the blends that are usually associated with Irish whiskey.

For example, Jameson is recognised the world over, and is a much-loved brand. It deserves every bit of its popularity as a blended Irish whiskey. But there is a whole lot more out there for whiskey aficionados to discover. Irish single malts and single pot still whiskeys are easily as high quality – if not higher – than their counterparts in the Scotch whisky market.

At The Craft Irish Whiskey Co., which I Founded in 2015, we bring another element to the Irish whiskey market. By creating only ultra-premium craft products, we don’t focus on volume, but on quality. Our aim is to offer the ‘Champagne’ of the Irish whiskey market. We’re the only Irish whiskey company to cask at 52% ABV. By adding water upfront, we use a unique aging process that is slower and more expensive, but the end product is rich, deep, flavourful and an Irish whiskey that shows off everything that’s great about this beloved product.

The future is bright for a revitalised Irish whiskey sector

There is no doubt that the popularity of Irish whiskey can grow from the still relatively small category to steal market share from American and Scotch whisky. Its future lies in diversifying the offering. While we’re crafting some of ultra-high premium Irish whiskey, there is space for other distilleries and whiskey producers to tackle other markets. There are new markets to conquer, including Asia and Africa, which offer massive potential. Other factors influencing the growth of Irish whiskey include:

- Consumer demographics – younger drinkers are making whiskey cool again.

- Emerging economies – middle classes in emerging economies are spending more on luxury categories.

- Russia and Eastern Europe – are buying more whiskey imports.

- More investment – in the production of high-quality Irish whiskey.

There is huge optimism for the Irish whiskey market from all sides. Premium and ultra-premium brands are offering limited editions, which are selling out. Long-standing brands are matching the new brands with collectables, and an Irish whiskey was crowned ‘best single malt’ at this year’s World Whiskey Awards. Meaning an Irish whiskey was awarded first place above all Scottish and Japanese single malt whisky for 2019. We can’t wait to see what 2020 brings, and as for The Craft Irish Whiskey Co., watch this space!

Leave a Comment