Are you looking to learn more about the leading payroll software platforms, to make your HR and finance operations more efficient? We’ve got you covered.

UK payroll processing presents unique challenges and demands. It requires comprehensive solutions made specifically to contend with intricate tax regulations, pension schemes, reporting requirements, and employment laws.

The top five payroll software platforms we’ve handpicked for you here have functionalities designed to contend with the complexities of UK payroll. These platforms ensure compliance with HMRC regulations, streamline auto-enrolment for workplace pensions, and effortlessly handle complex calculations such as National Insurance Contributions (NICs) and Statutory Sick Pay (SSP).

These payroll software platforms offer the flexibility and scalability required to adapt to the evolving UK payroll landscape. Let’s dive right in.

What are payroll software platforms?

Payroll software platforms are powerful digital tools that simplify and automate generating payslips, managing employee compensation, tax deductions, and other payroll-related needs.

Payroll solutions provide a centralised hub for managing all payroll-related tasks, from calculating employee salaries and tax deductions to issuing payments and handling statutory reporting. These tools streamline the payroll process, eliminating manual calculations and reducing errors that can lead to compliance issues or financial penalties.

The software platforms offer features that ensure compliance with His Majesty’s Revenues & Customs (HMRC) regulations. They automatically calculate and deduct National Insurance Contributions (NICs) and income tax based on tax codes and thresholds specific to the UK tax system.

Additionally, payroll platforms handle complexities such as Statutory Sick Pay (SSP) and help manage auto-enrolment for workplace pension schemes, ensuring compliance with the Pensions Regulator’s guidelines.

Every payroll software platform has unique features and functionalities, and the five below are good tools to start with.

1. Pento

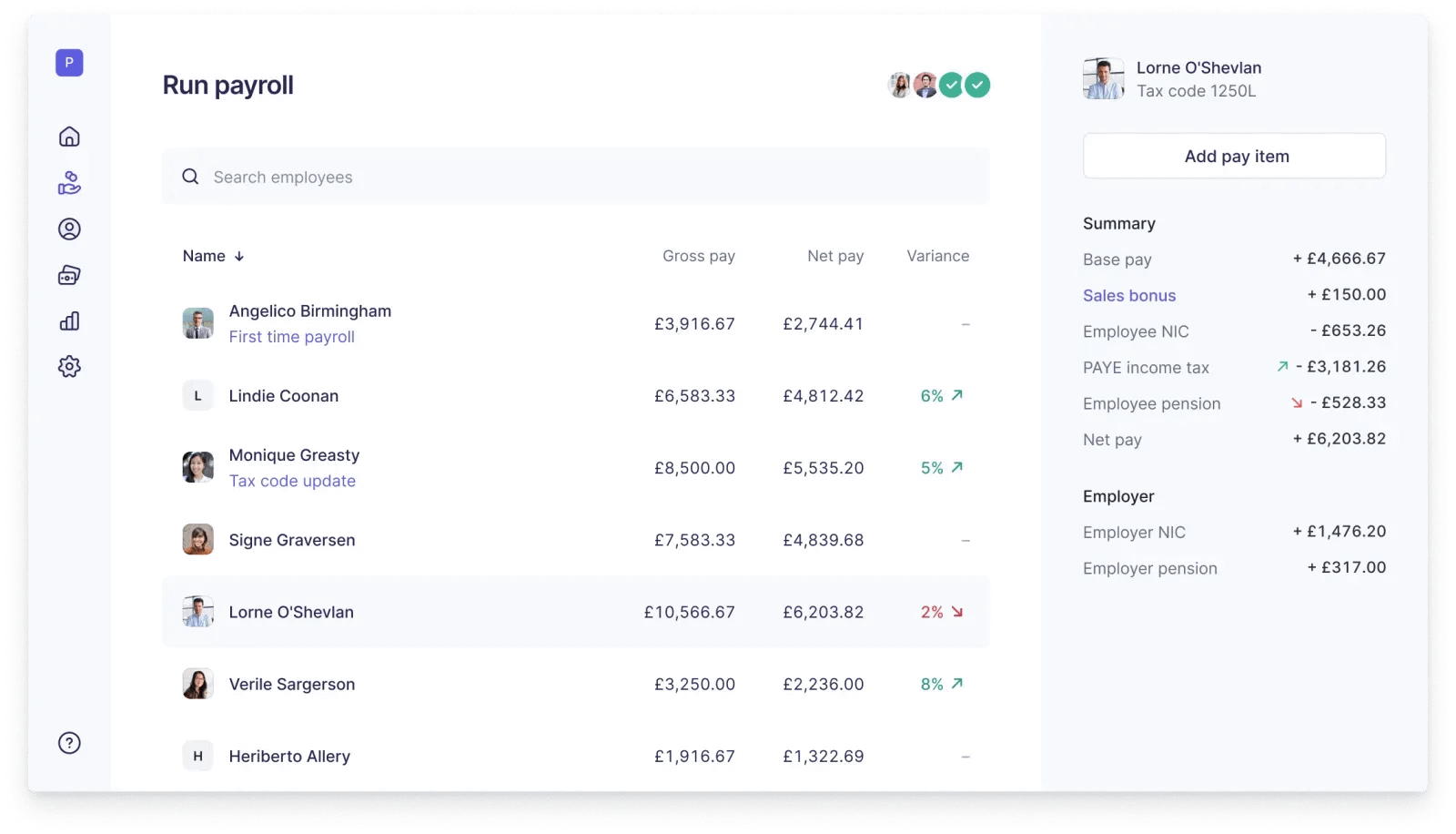

At the top of this list is Pento, with its user-friendly, automated payroll platform that can automatically calculate taxes, generate reports to pension providers and HMRC, and make bank payments.

Image source: pento.io.

Traditional methods often involve outsourcing payroll to reliable accounting bureaus and providers. However, these methods can be costly and complex and include manual data input, which is error-prone and time-consuming with the endless back-and-forth between you and the bureau.

Pento’s fully automated payments help your finance teams and payroll manager streamline workflows while giving you complete control over payroll management, HR, and finance operations.

Pento’s key features include:

- Automated tax and salary calculations, including payouts with single payments.

- Support from payroll experts, such as Chartered Institute of Payroll Professionals (CIPP) accredited payroll specialists.

- Visibility, flexibility, and control over your payroll and, in turn, your HR and finance processes through custom data exports, multi-user approval flows, and a detailed audit trail.

- Seamless integrations with other platforms, such as leading accounting solutions like Xero, HR software like HiBob, and pension providers. These integrations allow easy data sharing across tools, reducing human errors, constantly switching between platforms, and eliminating double entries.

Pento syncs with HMRC, minimising compliance issues and eliminating late reporting and deliberate or unintentional errors resulting in penalty charges. It automatically updates employee information, makes payments to HMRC before crucial deadlines, and auto-enrols eligible employees for their respective pensions.

Pento’s pricing starts at £5 per employee per month with a minimum fee of £149.

2. Rippling

Rippling is a one-stop shop for employee management. It links HR and IT management, including payroll, benefits, talent, and employee management, in one platform.

Rippling offers a user-friendly interface for easy navigation. However, its number of features can make onboarding challenging, since it includes a steep learning curve.

Like many leading payroll software platforms, Rippling complies with global data protection and applicable regulations. It also has licensed subsidiaries to manage specialised services, such as payments, insurance, and Professional Employer Organization (PEO).

Image source: rippling.com.

Rippling’s other main features include the following:

- Applicant tracking for job postings, document storage and online onboarding, and learning management for training materials through HR Cloud.

- State, federal, and local payroll tax calculation, filing, and deduction.

- Time tracking app that syncs with your payroll for easy review and approval.

- Robust analytics and reporting.

However, these features are limited and can be challenging to learn and master, unlike Pento’s easy-to-use and more comprehensive reporting and analysis tools.

Rippling’s pricing can be tough to assess, though, since you must get a custom quote from their sales team. The platform can also be overkill if you only want a payroll solution. It’s better suited to businesses that prefer managing all HR-related operations in one software. While Rippling is a strong contender, Pento’s usability, affordability, and reporting tools are stronger.

3. PayFit

PayFit is a cloud-based payroll solution that automatically generates payslips and offers attendance and time tracking, as well as real-time reporting. The software can make your payroll processing more efficient, while giving you insights into your HR operations.

PayFit provides comprehensive reporting features with detailed time management, time-off, expenses, and payroll reports to help your managers stay updated. It automates P11D submissions and provides a dedicated support team to assist you.

The software can integrate HR and time management systems, including SAP, Kelio, and Bodet. It also provides automatic overtime and leave entitlement calculations based on your company’s policies and the worked hours, including customizable time-off policies.

PayFit offers a similar payroll software platform model to Pento.

Image source: payfit.com.

However, for many businesses, Pento may be a better option since it offers more comprehensive and advanced integrations, automation, calculations, and services, such as more complex payroll cases. While PayFit has a self-service portal for employees and a free trial, Pento arguably performs better.

PayFit’s pricing starts at £150/month, with a £0 Base fee and £6 per employee.

4. PayCaptain

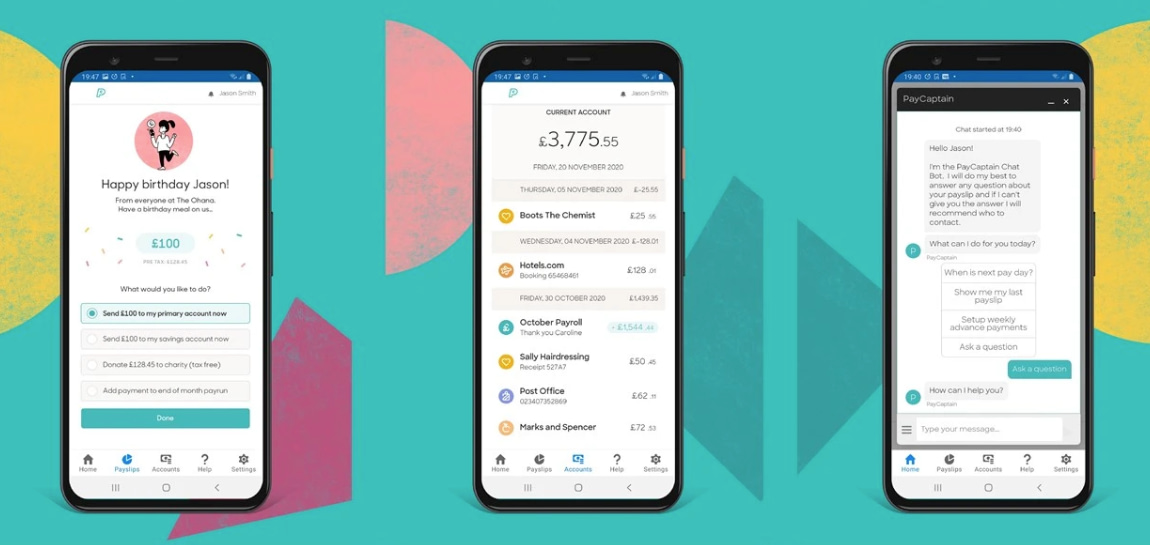

PayCaptain is a cloud-based HR and payroll solution that offers an optional fully managed bureau service.

Image source: paycaptain.com.

The software can integrate with third-party systems and offers a self-service payroll experience and flexible payment processing features, including BACS and Faster Payments.

Some of PayCaptain’s main features are:

- Employee self-service for P60, P45, payslips, and more.

- Pension contribution processing

- On-demand pay solution

- FCA registered e-money accounts

- Employee financial wellbeing tools and guidance

PayCaptain provides round-the-clock automated support and a team of payroll experts available during standard business hours. All customers have a designated account manager.

Unlike fully self-service platforms, PayCaptain’s pricing model is customised to each user’s needs. You’ll need to request a quote to know how much you must pay to use the software.

As of writing, PayCaptain doesn’t sync directly with Xero, which can be a bummer if you want seamless integration between your payroll and accounting systems.

5. QuickBooks payroll

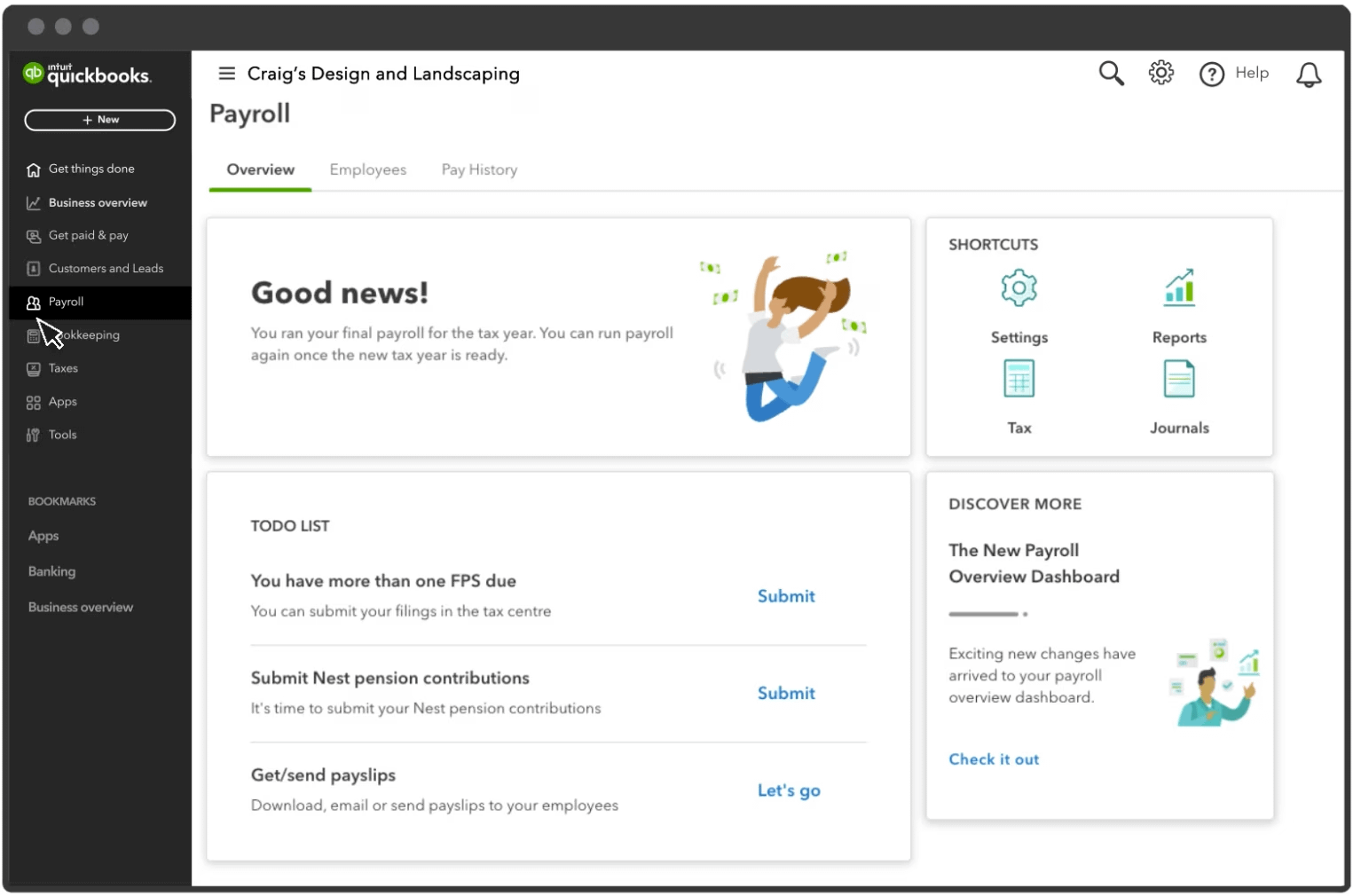

QuickBooks Payroll by Intuit is a cloud-based payroll service that you can use with QuickBooks Online or as a stand-alone service.

The stand-alone payroll processing solution offers the essential features to handle up to 150 employees.

Image source: quickbooks.intuit.com.

QuickBooks Payroll has the usual payroll features, such as:

- Unlimited payroll runs

- Automated tax calculations, including filing

- Benefits administration

- A single, intuitive interface containing all relevant applicable labour laws, payroll compliance, and exemptions (the downside is that you must sign up with QuickBooks partners to access these features).

- Extensive support, including a QuickBooks expert that guides you through complete setup.

- Reporting features, including payroll deductions and contributions, payroll billing summary, workers’ compensation, total pay, payroll tax liability, and others.

The solution doesn’t integrate with accounting software besides QuickBooks Online, which isn’t ideal if you want to combine data and workflows with your existing accounting platforms.

QuickBooks Payroll can be more expensive than many leading competitors. Time-tracking features are also available only for higher-tier plans.

Which payroll software platform is for you?

Finding the right payroll software platform optimises your HR and finance operations, saving time, reducing errors, and improving overall efficiency.

The top platforms in this blog post offer features and benefits tailored to different business needs. Assess your requirements, consider each platform’s features and integrations, and choose what best aligns with your company’s goals.

Doing so paves the way for smoother payroll management and ultimately contributes to your business’s growth and success.

Leave a Comment