The Dow Jones Index (US30) regained over 680 points during trading on Thursday, trading at $39,400 on Friday.

The markets attempted once again to push stocks into an upward trajectory after a short-term decline fueled by renewed recession fears in the U.S. Market flows have begun to return to normal somewhat, with indices trying to regain lost strength.

However, the Dow Jones remains unstable and strives to recover the pivotal 40,000 level.

Initial unemployment claims in the U.S. for the week ending August 2 totalled 233,000, which is lower than the expected 240,000.

The lower initial unemployment numbers help ease recent slowdown fears among investors after last week’s U.S. employment data spurred strong risk-avoidance in the markets.

The market will be watching a new set of inflation numbers at the producer and consumer levels, scheduled for release next week.

Amid this period of anticipation and waiting, the Dow Jones surged, with almost all securities listed on the index rising on Thursday. Walt Disney Co. (DIS) ended the day at just below $86.00 per share after reporting weaker-than-expected earnings from its theme park operations, despite increased revenue from other services.

Intel Corp. (INTC) shares recovered, rising about 8% and nearing $20.50 per share after recently hitting a 52-week low. I believe the tech giant is seeing a rebound in its stock price after investors were spooked by a slight drop in Q2 earnings and negative future guidance for Q3.

Regarding the recent downturn, the financial market experienced a seismic shift last week, causing investors to recognize underlying economic risks. When U.S. stock markets dropped sharply last Monday in a violent sell-off that led to investor panic, the severity of the panic eased by the end of the week, but the numbers remain troubling and reflect the significant challenges ahead.

The Dow Jones fell by 2.6%, down 1,399 points, while the Nasdaq dropped by 3.43%, or 576 points. The S&P 500 saw a 3% decline, and the Russell 2000 fell by 3.33%. These sharp declines led to a $6.4 trillion loss in global stock market value. The Japanese Nikkei index also suffered a significant decline of 13.2%, primarily due to the Bank of Japan’s decision to raise interest rates. In my opinion, this holds the key to what happened.

It’s worth noting that two main factors contributed to this turmoil. The first is the Bank of Japan’s decision to raise the benchmark interest rate to 0.25%, marking the second increase since 2007. I believe this rate hike strengthened the yen, leading investors to sell dollar-denominated assets, which negatively impacted global markets.

The second factor is the disappointing U.S. jobs report, where the American economy added only 114,000 jobs in July, far below the expected 175,000. Additionally, the unemployment rate rose to 4.3%, higher than the anticipated 3.1%. In my view, these numbers raised concerns about a potential U.S. recession, especially if the Federal Reserve does not respond adequately to inflation and interest rates.

In my opinion, central bank policies contribute to creating a massive debt bubble by encouraging borrowing at low interest rates, exacerbating economic risks. The long-standing low interest rate policy of the Bank of Japan led to a proliferation of interest-bearing bond trading, and the sudden rise in the yen’s value may have triggered a broader market crisis. The Federal Reserve faces a dilemma between cutting interest rates to stimulate the economy or keeping them high to combat inflation. Historically, the Fed tends to cut rates quickly during crises, often worsening economic issues, though it might make a different decision this time.

The validity of the above analysis is evident as even traditional safe havens like gold and silver saw notable declines, with gold dropping by 3.2% on Monday and closing down by 1.3%, while silver fell by 7.2%, indicating decreased industrial demand. I believe these declines are part of a natural price cycle where investors sell assets to cover margins, but historically, gold tends to recover faster than stocks after crises.

Despite the temporary recovery, underlying issues persist. The economy is burdened with debt due to post-2008 policies, putting pressure on the Federal Reserve. The Fed must deal with the dilemma of either reducing monetary stimulus or facing excessive inflation, with significant risks for a slowing economy. Historically, Fed interest rates have hovered around 4.95% since 1970, and current rates are approaching this level. The pressing question now is how well the Fed can manage the economy without exacerbating the crisis.

Despite the current calm in the markets, investors should proceed cautiously, as market volatility is likely to continue until about mid-next week. It may be a good time to bolster investments in gold and silver as safe-haven assets, prepare for inflationary pressures and future economic fluctuations, and ensure the financial portfolio is robust enough to withstand upcoming shocks. I anticipate that economic and geopolitical volatility will remain expected in the near to medium term, and it is wise to monitor developments and adjust investment strategies accordingly.

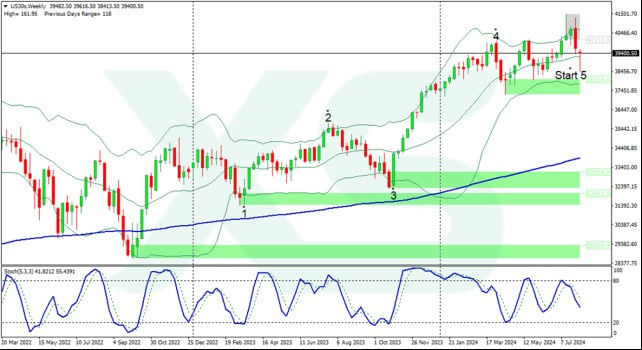

Technical analysis of Dow Jones (US30) prices

On the daily chart, the Dow Jones Index has regained the 39,000 level in another attempt to build new bullish momentum. From a technical perspective, a third retest of the same level is often successful after repeated failures to make significant progress this week.

However, a drop in the index below 38,500 following its recent three-day decline, which saw the stock market fall by -6.58% from high to low, would be concerning. Optimism will continue to prevail in prices as long as the Dow Jones remains above the 200-day Exponential Moving Average (EMA) at $38,011.45.

Dow Jones – US30 – Prices Chart MT4 –-XS.com

The Dow Jones Index closed lower yesterday but remained close to the main trendline. The index might be on the verge of a bearish breakout but could also bounce back to negate the current bearish outlook. If a bearish breakout occurs, the price may approach 38,000 as it reacts to upward movements. On the positive side, a move above 40,000 could confirm the continuation of the bullish trend.

Elliott Wave analysis for the Dow Jones suggests that the market is in a trending phase characterized by an impulsive pattern. The primary wave pattern currently visible is the upward wave number 3, indicating strong bullish movement. The market has recently begun forming the final wave number 5 in the main Elliott pattern, which continues the overall bullish impulsive trend.

This means that the market is experiencing a strong upward movement. Typically, wave 3 in Elliott Wave Theory is the strongest and longest, often leading to significant market gains. With wave 2 complete, wave 3 is expected to push the Dow Jones to higher levels if the bullish momentum persists.

As wave 2 has ended correctly, the downward correction is considered complete, and the price is beginning to gather momentum for a strong upward phase. However, another corrective phase might occur to complete wave 4, which is expected to temporarily reverse the main trend before the market resumes its upward path. The wave cancellation level is at 38,900.53, which is crucial to validate the current wave structure. A drop below this level would invalidate the expected wave pattern, necessitating a reassessment of the current market trend.

Support Levels: 39,256 – 38,999 – 38,011.45

Resistance Levels: 39,770 – 40,000 – 40,470

Leave a Comment