The message, over the last 10 days or so, from monetary and fiscal policymakers across the globe, has been clear, and undeniable – the policy ‘put’ is well and truly back.

The FOMC kicked things off on this front last week, delivering a larger-than-expected 50bp cut to the fed funds rate.

Driving this decision, which was presumably influenced by markets pricing a 6-in-10 chance of such an outcome prior to the meeting, was a desire among policymakers not to fall behind the curve, and to ‘stick’ the soft landing, amid updated forecasts which pointed to unemployment rising to 4.4% this year, and to quicker progress back towards the 2% inflation target than had previously been expected.

In short, the FOMC’s pain threshold had been hit, and policymakers responded in kind.

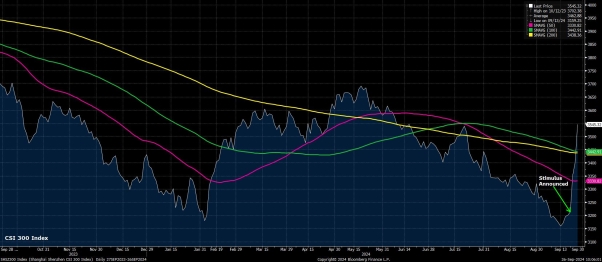

Meanwhile, in China, authorities have thrown the proverbial kitchen sink at the economy this week.

Tuesday brought a barrage of stimulus, including – a 20bp RRR cut; a cut to outstanding mortgage rates; a liquidity injection of up to 500bln CNY to support the equity market; a new PBoC swap facility to further support the market; and, studies into the establishment of a ‘stock stabilisation fund’.

If this wasn’t enough, this has been followed by a $142bln capital injection into major domestic banks, as well as a Politburo directive to implement “forceful” rate cuts, and ensure “necessary” further fiscal spending is delivered.

It is debateable the degree to which any of these measures will turn the tide for the Chinese economy, which continues to grapple with deep-rooted structural issues, remains stuck in a debt-deflation loop, and is struggling with serious demographic issues. That said, the message is clear – the PBoC shan’t tolerate much further by way of substantial equity weakness.

In short, the PBoC’s pain threshold has been hit, and policymakers have responded in kind.

Turning to the eurozone, recent economic data has been somewhat vomit-inducing. September’s ‘flash’ PMI surveys pointed to the services sector expanding at its slowest pace in 7 months, while the manufacturing index fell to a YTD low. More broadly, the composite PMI pointed to an overall contraction in economic output for the first time since February. We await the September inflation figures, though anecdotal evidence suggests a further substantial drop in headline price pressures when those reports are released.

Subsequently, the ECB have taken tentative steps to respond to this faster-than-expected loss of economic momentum. Recent ‘sources’ stories indicate that an October rate cut is now on the table, with the meeting seen as “wide open”, with the Governing Council’s doves set to fight for a second straight rate cut amid softening data.

In short, the ECB’s pain threshold looks close to being hit, and policymakers are likely to soon respond in kind.

Elsewhere – the Bank of Japan have begun to pivot in a more dovish direction, with Governor Ueda nothing that upside inflation risks have “eased”; the Bank of Canada look set for their own ‘jumbo’ cut next month, after remarks from Governor Macklem touted the possibility of a larger move; the Riksbank have pencilled in the possibility of a 50bp cut before the year is out; and, the SNB also look set to continue to ease aggressively, even as rates approach the ZLB.

The message, then, is clear – with inflation back under control, policymakers are happy to place greater weight on supporting economic growth. Across the world we are at, or close to, the pain thresholds at which policymakers will enact a forceful response. This response, and the liquidity that it will likely provide, should continue to provide significant support to risk sentiment.

Participants have, thus far, taken onboard the “we’ve got your back” messaging from policymakers, with equities continuing to trade well. The path of least resistance is likely to continue to lead to the upside, over both the short- and medium-term, with this positive policy backdrop unlikely to change any time soon.

While the ‘real world’ efficacy of the measures mentioned in this note may well be debateable, their impact on financial markets is clear. Fighting the Fed, or other central banks, seldom ends well.

Leave a Comment