When tariffs on Indian imports doubled this summer, U.S.–India trade operators were understandably shaken.

For many mid-size companies, the announcement wasn’t just a headline, it was a stress test.

External shocks like tariffs, pandemics, or supply chain breakdowns often expose a hidden truth: too many family-owned businesses have no real plan for what happens when leadership suddenly changes.

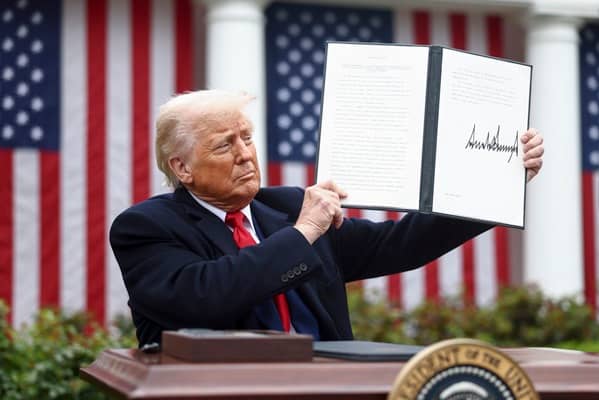

NPR reported that President Trump’s decision to raise tariffs from 25% to 50% was an escalation that continues to reverberate across global markets, underscoring how quickly the ground can shift.

Family enterprises are the backbone of the American economy. They generate more than half of U.S. GDP, employ nearly 60% of the workforce, and account for over 80 million jobs, according to the Family Business Center. Yet despite their scale, they often remain fragile when it comes to leadership continuity.

The problem isn’t the quality of the businesses, it’s the assumption that succession will somehow sort itself out.

The outdated assumption

For decades, succession planning in family businesses followed a predictable script: when the founder steps away, a child steps in. But today, many heirs want no part in running the business.

They pursue careers elsewhere, seek personal freedom, or simply lack interest in the grind of daily operations. Hoping a son or daughter will automatically take the reins is no longer realistic and clinging to that hope leaves businesses dangerously exposed.

The result? Leadership vacuums, conflicts between siblings, and stalled decision-making. Even healthy, profitable companies can quickly lose momentum if no one is prepared to lead when the founder exits.

Succession as strategy, not retirement

Succession planning isn’t just about naming the next CEO. It’s a multi-year process of preparing a business to outlast its founder. That means:

- Leadership development: Identifying and mentoring potential successors, whether they’re family members or trusted employees.

- Governance structures: Creating advisory boards or councils to guide decisions and reduce the burden on a single individual.

- Risk management: Cross-training employees, formalizing key processes, and securing financial safeguards so the business can withstand shocks.

Looking beyond the family tree

Many of the most successful successions I’ve seen happen when families broaden their thinking beyond bloodlines. A longtime store manager or operations lead may be better equipped than an uninterested heir to run the business day-to-day. Ownership and leadership don’t have to be the same thing, families can retain equity and influence while entrusting management to someone who’s earned the confidence of employees and customers.

This shift in mindset is crucial. Legacy is not just about keeping a last name on the door; it’s about keeping the doors open for the next generation of workers and customers.

Why timing matters

One of the most common mistakes owners make is waiting until a crisis forces the conversation. Illness, burnout, or sudden retirement should not be the triggers for succession planning. By then, options are limited, leverage is gone, and transitions become reactive rather than strategic.

The right time to begin is not “five years before retirement.” The right time is now. Even if a founder has no intention of stepping back soon, beginning the process early creates flexibility. It allows time to test potential successors, to set up governance, and to ensure continuity if the unexpected happens.

More than survival, growth

The strongest succession plans don’t just preserve the business, they position it to grow. A company that has cross-trained employees, established cash flow protocols, and empowered a new generation of leaders is better equipped to respond quickly to external shocks, whether tariffs, recessions, or supply chain disruptions.

In fact, some families find that the process of planning succession sparks innovation. Preparing for the future often prompts diversification, modernization, or new investments that otherwise might have been delayed. What starts as risk management can end as a growth strategy.

A shift in mindset

As NPR noted, tariff battles between the U.S. and India reflect broader geopolitical uncertainty. These headlines may fade, but the lesson remains: disruption, whether from politics, economics, or global markets isn’t going away. Family-owned businesses have two choices: assume succession will happen naturally and risk the consequences, or treat it as a deliberate strategy and secure their legacy.

Legacy is not a guarantee, it’s built, planned, and protected. And the families that understand this truth will be the ones whose businesses endure, not just through the next generation, but for many more to come.

Get real time update about this post category directly on your device, subscribe now.

Leave a Comment