It’s fair to say that Robinhood is the biggest name in the retail investing ecosystem today. The investing app has grown exponentially owing to a simplified user experience and 0% commission structure for investors. However, in 2021 the company confirmed that its “global expansion plans are on hold for now,” indicating that the app won’t be coming to the UK any time soon.

This is likely to be frustrating news for the large numbers of UK retail investors who are looking to find a user-friendly platform to enter the world of investing.

As Nasdaq data shows, since brokerages started to offer zero-commission services to investors, trading volume has comprehensively grown as platforms welcomed scores of new arrivals in the wake of the Covid-19 pandemic.

In terms of downloads alone, Robinhood has comfortably outpaced its nearest competitor in the cryptocurrency platform, Coin base. Interest in Robinhood spiked in January 2021 as news spread of retail investors coordinating together to launch a short squeeze on GameStop stocks.

However, UK investors may have felt as though they’ve been watching from the side lines as the excitement unfolded. With Robinhood making it clear that they’re not planning on entering the UK market for the foreseeable future, let’s explore some of the leading alternatives available domestically:

1. Freedom24

Freedom is the only EU-based online brokerage to be listed on the Nasdaq, and it’s also the first of its kind to offer its users access to IPOs – an extremely scarce financial service that’s usually off-limits to the world of retail investors.

Traders using Freedom24 can access markets from all around the world, including the likes of the NYSE, Nasdaq, HKEX, LSE, Deutsche Börse, KASE and MOEX, with users capable of tapping into over 40,000 financial instruments – including the stocks of S&P 500 and the world’s leading companies, options, futures, corporate and government bonds, and many investment funds.

If you’re looking for a comprehensive level of access to investment opportunities, there are few better options on the market than Freedom.

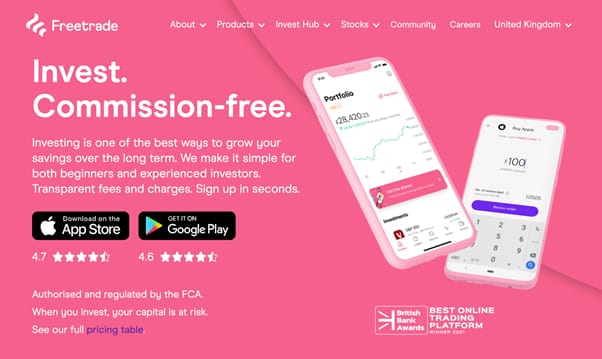

2. Freetrade

Free trade stands as the UK’s closest equivalent platform to Robinhood. With a zero-commission operating model, stock and investment trading platform and fractional share investing capability, Free trade offers a wide range of options to investors and a great way of helping them to grow their portfolio as they see fit.

So, how does Free trade make its money without commissions? The platform offers a freemium model that’s reminiscent of Spotify or Zapier. This enables them to combine all transactions made on the platform and complete trades once a day – allowing them to benefit from economies of scale and extremely low dealing costs.

This model helps Free trade to offer General Investment and Share Dealing Accounts at zero cost, which can be excellent for long-term investors who can save on the fees that may eat into their returns.

3. eToro

Another platform that champions cost-effective convenience is eToro. Like Robinhood, eToro offers zero-commission trading. Users can also benefit from a demo account so that they can practice investing, and a suite of professional tools and research helps investors to make solid decisions before placing their money into a specific investment.

In what’s undoubtedly a major benefit for investors who are eager to keep their finger on the pulse at all times, eToro also enables offline trading – making it possible for orders to be placed even if the platform is down.

The greatest strength of eToro is that it enables the trading of a massive range of stocks, commodities, currencies and even cryptocurrencies – with 1,000 listings all around the world. This makes it extremely easy for retail investors to swap between investing in gold during a downturn to buying the brightest new tech IPOs. They can even divert money into more speculative assets like Bitcoin should they wish.

4. Revolut

Another platform that offers a wide range of assets including crypto and precious metals is Revolut. Founded in 2019, Revolut Trading is a relatively recent extension of the company’s app – providing users with an easy way to invest without having to move their funds elsewhere in the process.

While Revolut’s platform is revolutionary is its performance as a one-stop shop for investing, it only allows investment in American stocks free of charge up to one transaction per month, cryptocurrencies with a spread of 1.5% and gold and silver with a spread of 0.25% when the market is open. However, the app carries no withdrawal or inactivity fees with its platform.

The best thing about the app is that it’s very user friendly and intuitive, and it takes a matter of minutes to securely set up an account. However, it’s fair to say that the platform’s still finding its feet in terms of the financial products it offers, and values can only be shown in dollars currently. Assets like ETFs, CFDs, Forex, bonds and options are currently inaccessible on the app, too.

Furthermore, there’s little in the way of educational or research services to justify the app’s annual custody fee of 0.12% – making Revolut a little expensive despite the great level of convenience it offers.

5. Webull

Webull stands as another intricate platform that can be a great place for more experienced investors to use. Short-term and active traders have the potential to save money on the platform’s zero-commission format compared to traditional brokers.

One of the best perks of Webull is that the platform offers a range of trading courses and simulator constructs that use real-time data and advanced charting capabilities for US stocks. These features can help beginners to get to grips with the platform and create smart trading plans.

The Webull platform can be accessed as a mobile, web-based, and desktop app with features to suit more experienced and intermediate traders and learning platforms to facilitate the growth of newcomers to investing. With this in mind, Webull has something to offer for everyone.

The beauty of emerging fintech platforms for trading is that the technology is still developing and companies are taking varied approaches to help facilitate the needs of retail investors as they go. This means that investors can really find a stock trading app UK that suits their specific needs, rather than opting for a variation of a tried and tested existing platform elsewhere.

UK app stores may be without the presence of Robinhood, but the strength of the competitors out there is such that investors of all levels of experience can find a platform that caters well to their needs.

The above information does not constitute any form of advice or recommendation by London Loves Business and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Appropriate independent advice should be obtained before making any such decision.

![Top developers to supercharge your smart TV app development [2024 Edition] Smart TV and smartphones, stars at IFA](https://mloyoq1wv9pf.i.optimole.com/w:300/h:198/q:mauto/f:best/ig:avif/https://londonlovesbusiness.com/wp-content/uploads/2024/07/Smart-TV-Panasonic.jpg)

Leave a Comment