There is an allure to alternative investments beyond traditional stocks and bonds, with luxury goods presenting a unique option.

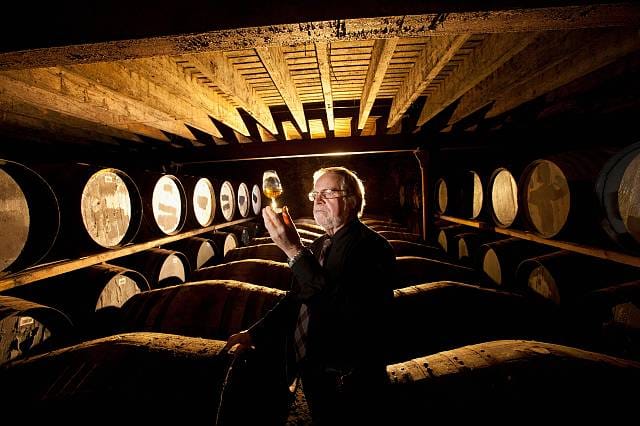

Alternative assets like rare whiskey have increasingly garnered attention among investors looking to explore unconventional avenues. According to Stocklytics.com, rare whiskey investments have accrued over 280% in returns for the past decade, beating the S&P 500.

Edith Reads, a financial expert from Stocklytics, commented on the development, “The emergence of whiskey investment funds and dedicated trading platforms has democratized access to the market, allowing investors of all backgrounds to participate in this lucrative asset class.

Additionally, the rise of technology and the solid performance of specific whiskey regions is driving the market forward.

Comparing luxury and the S&P 500 returns

The whiskey market is poised for significant growth in the coming years. In 2024, its total revenue has reached US$92.9 billion, with an expected annual domestic growth rate of 4.33% from 2024 to 2028.

Whiskey auctions have broken records since the onset of COVID-19, with auctioneers settling with millions for a single bottle. In November 2023, a rare whiskey with only 40 bottles produced, The 60-year-old Macallan Valerio Adami, fetched a staggering $2.7 million at a Sotheby’s auction.

Several factors contribute to the rise in rare whiskey performance; among them is scarcity. Aged Whisky is continuously becoming rare, leading to increased demand and prices. Besides, its prestigious and exclusive allure draws collectors and investors.

Meanwhile, returns from the S&P have also been impressive, surpassing 158% and outperforming other luxury investments such as wine (146%), watches (138%), and art (105%). However, when comparing individual luxury investments to the S&P, the allure of luxury investing becomes apparent. The poorest-performing investments were colored diamonds and jewelry, both yielding returns below 40%.

Expect returns when investing in whiskey

Returns on whisky investments can range from modest to substantial. These returns depend on the investor’s level of expertise and the specific bottles or casks acquired.

According to some reports, high-quality, rare whiskies have seen annual returns of around 10% to 20%, although this should not be considered a guarantee. It’s crucial to note that these numbers are historical averages and may not necessarily reflect future performance.

Investing in whisky casks can also be profitable but tends to require a longer-term commitment.

Rare whiskey is a rosy investment; beware of the thorns

Although lucrative, rare whiskey investment has its bottlenecks. There are constant regulatory dynamics, and the valuation of whiskey is always subjective, posing a challenge to investors. Moreover, investors must worry about market volatility as things may rapidly change.

Despite the challenges, whiskey investments remain the best compared to other luxury investments. It provides a suitable alternative for investors looking to diversify their portfolio from S&P, and the risks involved are manageable with proper market research and due diligence.

Leave a Comment