That scratching sound you can hear in the background is a raft of analysts and market forecasters hurriedly updating their end-of-year price targets for gold and silver. Again.

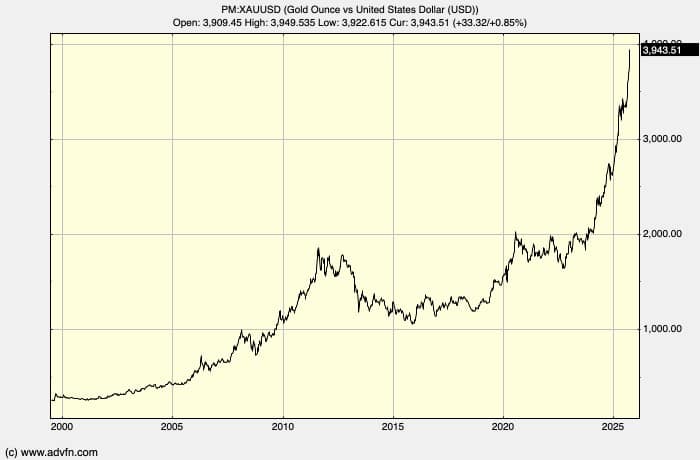

Both precious metals are enjoying their best year in decades, with gold showing year-to-date gains of 50% and silver climbing nearly 70%.

With monetary tailwinds still blowing strongly, further gains are expected in the fourth quarter and beyond, prompting experts to revise their forecasts upward repeatedly throughout the year.

The drivers of this multi-month rally remain consistent and compelling.

These include a weakening US dollar, which has declined 10% year-to-date, hefty central bank gold purchases, an uneasy geopolitical background, and a loosening Federal Reserve policy stance.

Added to these familiar factors, there is now a growing sentiment that the US dollar is starting to lose its pre-eminence as the world’s dominant reserve currency, with a number of other asset classes, including precious metals and Bitcoin, seeing heavy buying and record highs. This confluence of factors has created what many forecasters see as a perfect storm for precious metals, with both institutional and retail investors seeking safe-haven assets in an increasingly uncertain global economic landscape.

Leave a Comment