The Cryptocurrency market is witnessing a downward trend on Monday, with Bitcoin and most major alternative currencies trading in the red zone. The current price of Bitcoin is at $25,948.50.

Meanwhile, the fear and greed index for digital currencies has been experiencing a downward correction since yesterday, still residing in the fear zone with a reading of 35 out of 100.

This came after the Federal Reserve Chairman, Jerome Powell, stated in his keynote address at the Jackson Hole Symposium held by the Federal Reserve Bank in Kansas City that tight monetary policy would remain necessary until inflation slows down sustainably. Powell added that the central bank is prepared to raise interest rates further, if necessary, although he emphasized that future decisions would be made with caution.

Initially, the price of Bitcoin (BTC) dropped slightly due to Powell’s hawkish remarks, but it rebounded positively over the weekend, reaching $26,200. The movement in Bitcoin’s price wasn’t surprising considering the overall downward trend in the days leading up to the Jackson Hole event. Traders anticipated Powell’s continued focus on lowering inflation to the central bank’s target of 2%.

However, on Monday, as the new trading week began, the price of Bitcoin (BTC) continued to decline and remained below the $30,000 level, settling at $25,948.50, a decrease of about 0.04% since yesterday. On the other hand, some other well-known digital currencies such as Cardano (ADA) and Solana (SOL) experienced modest gains of around 0.95%.

Ethereum is being traded at $1,648.74, reflecting an increase of approximately 0.11% over the past 24 hours. Among other prominent digital currencies, the price of Ripple’s XRP increased by 1%. Simultaneously, the Polygon (MATIC) index saw a rise of 0.86% yesterday. At the same time, the price of Polkadot decreased by around 1.10% within a day.

The past 24 hours have shown a recurring pattern in the Cryptocurrency markets. Dogecoin’s price has dropped by around 0.39%, while Shiba Inu’s token price rose by approximately 1.28% during this time frame, maintaining the advantage for meme-based currencies.

Today, the Cryptocurrency market appears predominantly bearish, except for a few digital currencies and meme tokens. The global market capitalization of digital currencies currently stands at $1.05 trillion. The 24-hour trading volume of the Cryptocurrency market is around $17.25 billion, representing an increase of nearly 18%.

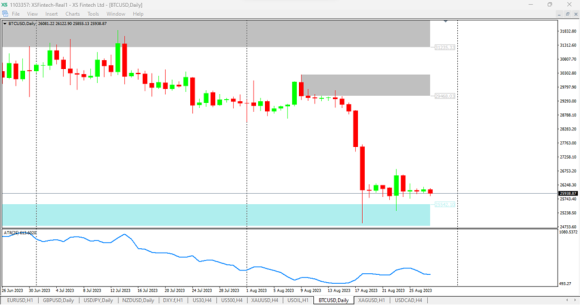

Below is a detailed technical analysis of Bitcoin’s price movements, which often lead the Cryptocurrency market:

The Bitcoin (BTC) price chart on the MT4 platform by XS.com

Bitcoin prices have been trading within a tight range between $25,752 and $26,282 over the past few days. Meanwhile, technical indicators are approaching the overbought zone on both the short and medium-term scales, suggesting a potential upward reversal for Bitcoin.

However, there won’t be a significant upward movement without a strong breach of the formidable resistance level at $30,000 and a daily close above it. At the same time, the bearish sentiment still holds sway over Bitcoin and the digital currency market in the short term, with potential targets of $25,500 and $25,100, respectively.

Leave a Comment