US stocks tumbled on Monday aver concerns as to how the US President’s sweeping tariffs will end up crippling the global economy.

US stocks hit their lowest levels on Sunday evening after being hit by stock futures.

On Monday the S&P 500 opened lower at 3.4%, the tech heavy Nasdaq Composite fell 4% and the Dow Jones dropped 3.2% or 1,200 points, CNN reported.

Investors could be looking at a buying opportunity as the Nasdaq has confirmed they are in a bear market and could end up with losses of over 20%.

CNN reported, James Demmert, chief investment officer at Main Street Research said, “We are getting close to a bottom.

“The fact that stocks have dropped so significantly in these deep intraday moves is a clear sign of indiscriminate and fear-based selling. When this happens, we tend to soon see significant rallies.”

Read more related news:

UK facing highest taxes since WWII and millionaires are fleeing the Chancellor’s ‘economic downfall’

Don’t panic, hold your nerve and you will be rewarded, economists tell Brits as Trump tariffs cause stock market meltdown

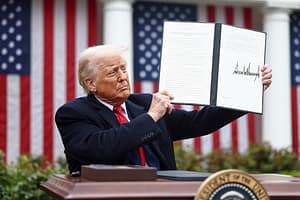

Trump warns ‘abusing countries not to retaliate’ over his sweeping tariffs

Understanding the LEI code: A key identifier for global financial transactions

More than £80 billion was wiped off the FTSE 100 amid Donald Trump’s “nuclear” sweeping tariffs.

In a recent post on X, hedge fund manager Bill Ackman wrote, “I would love to be proven wrong and watch this approach to tariffs and/or their resolution be enormously beneficial to our country and the global economy.”

Susannah Streeter, head of money and markets, at investment platform Hargreave Lansdown said, ‘’The big flight to cash continues as investors seek a shelter for their money amid the tariff storm.

“Trump has dashed hopes for an easing of policy by calling tariffs ‘medicine’ and investors are absorbing the implications of this bitter pill for the global economy.

“The tech-stock turmoil looks set to rampage for another day on Wall Street. The bears are already out in force across the Nasdaq, and futures indicate another steep fall for the index.”

Russ Mould, investment director at brokers AJ Bell said, “This market sell-off feels brutal because it is relentless. Often, we see one or two bad days then a rebound.

“We’re now on day three and the sell-off is intensifying, not dying down.

“Fundamentally, investors are worried about a big hit to corporate earnings and a massive slowdown in economic growth. The potential end to globalisation throws up more questions than answers and that uncertainty is causing havoc on the markets.”

Leave a Comment