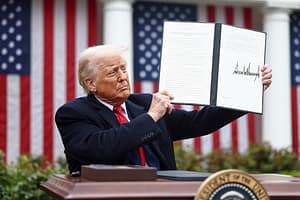

The U.S. dollar continued to weaken despite former President Trump denying recent reports that his administration might consider softer tariff measures.

The uncertainty around the new administration’s policies could affect the market and fuel some volatility for the dollar. Moreover, market participants are anticipating key economic data releases, including JOLTs, ISM, Non-Farm Payrolls, and FOMC minutes and could remain cautious.

Robust data coupled with a hawkish Federal Reserve stance could bolster the dollar, while disappointing figures may weigh on the greenback.

Meanwhile, stronger-than-expected European economic data and resilient German inflation have sparked speculation that the European Central Bank could potentially scale back its aggressive rate-cut trajectory, providing support for the euro. The ECB’s upcoming interest rate decision will be closely monitored for its impact on the dollar-euro exchange rate.

In the bond market, U.S. Treasury yields remained steady and hovered near their recent high, with the 10-year note yield holding above 4.5%. However, volatility is expected to increase in the coming weeks, potentially impacted by Trump’s inauguration and the Fed’s upcoming rate decision. Persistent inflation risks and the Fed’s hawkish outlook may continue to support both US yields and the dollar.

Leave a Comment