The UK job market remained on a cautious upward trajectory in May, with yearly growth continuing to climb, even in the face of month-on-month declines, according to the latest UK Job Market Report by job matching platform Adzuna.

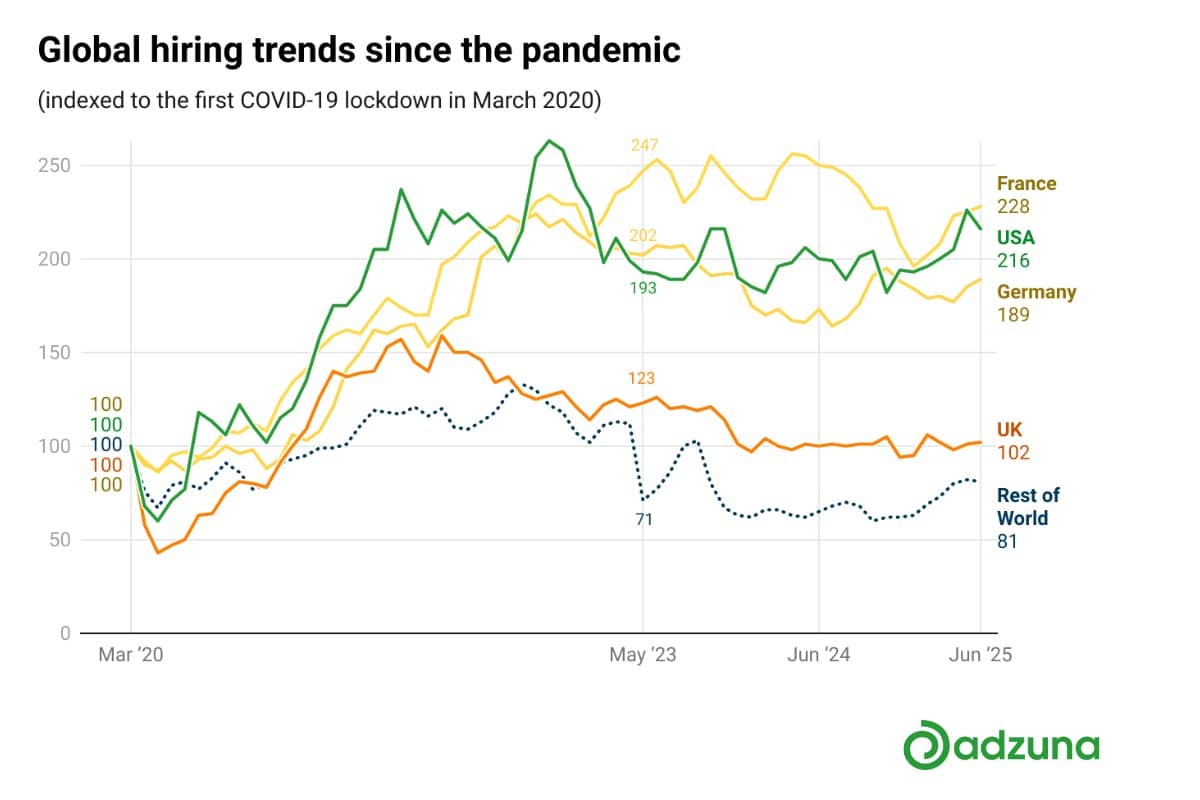

Month-on-month vacancies dipped -0.51% last month to 858,465, but remained +0.49% higher than May 2024, the third consecutive month of year-on-year gains. Zooming out to a global scale, vacancies in the UK returned to pre-pandemic levels, outperforming the global average but still behind major markets such as the US, France, and Germany. (Graph 1)

At the same time, following the National Minimum Wage increase of +6.7% in April 2025, average advertised salaries rose to yet another record high of £42,403 – up +0.3% on April’s figures, +9.38% above last year’s level and the strongest run of annual pay growth since mid-2022. Annual pay growth across the private sector as a whole rose by +5.1% in May, with the public sector seeing slightly higher annual pay growth, at +5.6% for the same period.

Graph 1: Global hiring trends since the pandemic

Healthcare & Nursing, which had been a steady driver of job market growth in previous months, saw a notable decline in May, with postings down -10.21% month-on-month. In contrast, seasonal jobs rose ahead of the summer holiday season, with postings in the Logistics sector up +9.77%.

The average time it takes to fill a job has settled at 35.8 days – down from 39.5 days and just above the 35.3-day mark for two months’ prior. This suggests that while hiring is moving slightly faster, employers are still navigating a tight talent pool; further supported by the fact the jobseekers per vacancy ratio rose to +2.02, up from +1.98 in April.

Elsewhere, salary transparency fell to 43.5%, reversing months of progress made at the start of the year and suggesting more employers are holding back on pay visibility.

As we head further into summer, May saw continued strength across seasonal and frontline sectors. Logistics & Warehouse roles increased +9.77%, whilst Creative & Design and Hospitality & Catering jobs rose +6% and +5.61% respectively. Teaching roles climbed again, by +1.63% with 169,064 live vacancies in May, keeping education the UK’s most active hiring sector.

However, gains were far from universal. Having been one of the UK job market’s most resilient sectors in 2025 to date – with strong vacancy and salary growth throughout Q1 – Healthcare & Nursing vacancies saw a sharp -10.21% dip in May. Admin (-9.22%) saw similar declines, followed by Maintenance jobs (-7.95%), and Domestic Help & Cleaning (-5.72%).

Graduate hiring also continued to weaken, with advertised vacancies falling a further -4.2% in May – now sitting -28.4% below the same time last year, and at the lowest level since July 2020. Looking more widely, entry-level jobs – including graduate jobs, apprenticeships, internships, and junior jobs with no degree requirement – fell -31.89% since ChatGPT commercial breakthrough in Nov 2022. Entry-level jobs now account for 25% of all jobs in the UK, down -3.86 percentage points from 28.9% in Nov 2022 and the lowest level since the breakthrough.

On the salary front, Teaching roles led monthly wage growth, rising +2.83% while Graduate salaries rose +1.1% to £25,427. This represents a +5.7% annual increase that may be indicative of just how competitive the market is for the best university leavers. At the opposite end of the spectrum, almost half (13 out of 28) of sectors saw month-on-month declines, with Travel dropping the most sharply at –3.83%, followed by Maintenance (–3.07%) and Energy, Oil & Gas (–2.67%).

However, yearly figures were much more promising. Logistics & Warehouse (+20.38%), Teaching (+15.75%), and Maintenance (+13.43%) all saw standout annual rises, while only one sector – Energy, Oil & Gas – posted an annual decline – a marginal -0.01%.

Roles in Legal and Admin remain the quickest to fill, averaging 32.1 days and 31.9 days respectively. Creative & Design roles last month took the longest to fill, at 42 days, followed by Energy, Oil & Gas at 40.2 days.

Northern Ireland once again led the UK on annual salary growth, with average advertised pay rising +12.63% year-on-year to £40,726. Annual salaries in the region have now increased by double-digit percentage points for four consecutive months and it remains one of now seven UK regions offering average pay above £40,000, after Yorkshire and Humber made the list for the first time in May. London remains the highest-paying region at £48,680, followed by Eastern England.

The number of jobseekers per vacancy increased in 10 of the UK’s 12 nations and regions last month, with Wales seeing the sharpest rise at +0.1. Five regions – London, North East, North West, West Midlands and Yorkshire and the Humber – saw identical +0.06 monthly rises. Northern Ireland and the South West experienced declines, with competition easing by -0.18 and -0.02 respectively.

The North East remains the most competitive region overall, with 3.32 jobseekers per vacancy, followed by Northern Ireland (3.21) and the West Midlands (3.18). At the other end of the scale, the South West continues to see the lowest competition, with just 1.32 jobseekers per role, followed by the South East (1.44) and Eastern England (1.67).

Healthcare Support Worker remained the most in-demand role on Adzuna’s Trending Jobs list in May, topping the Interest Quotient rankings for the sixth month in a row. Social Care Worker held onto second place, followed by Sales Assistant, which climbed into the top three for the first time this year. Warehouse Worker dropped to fourth, after briefly reclaiming second in April. This ranking is based on the Interest Quotient, a metric that tracks how often job postings are viewed relative to other occupations. A higher quotient reflects stronger interest among jobseekers.

Further down the list, Software Developer re-entered the top five – marking a return to tech interest after dropping out in March and April – while Cleaner, Healthcare Assistant, and Administrator

Leave a Comment