The ASX 200 has seen around $100 billion wiped from local stocks as the Australian stock market has been hit with their largest drop in five years amid the US President’s tariffs war.

The S&P/ASX 200 plummeted by over 4% and closed at 7,343 points, which has not been seen since December 2023, the Guardian reported.

Luke McMillan, the head of research at Sydney-based Ophir Asset Management said, “It’s a bloodbath on the share market today in Australia.”

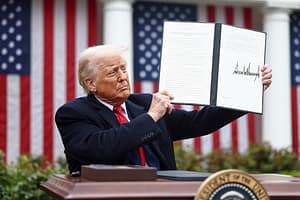

McMillan added, “The key difference from those other periods is that this one is started by one person, essentially – being the US president.

“We just haven’t really had one person cause a bear market, let alone the president.”

The Guardian reported, Omkar Joshi, the chief investment officer at Sydney-based Opal Capital Management said, “If we have a situation where no one backs down and we see more retaliation from both sides, it gets trickier and there’s every possibility that we do continue to go lower from here.

“My personal view is I don’t think the Trump administration is going to back down quickly or in any meaningful manner.

“You can almost argue it’s the market’s fault for not believing Trump, because he’s actually been pretty transparent about what he wants to do, and the markets haven’t been listening.”

Leave a Comment