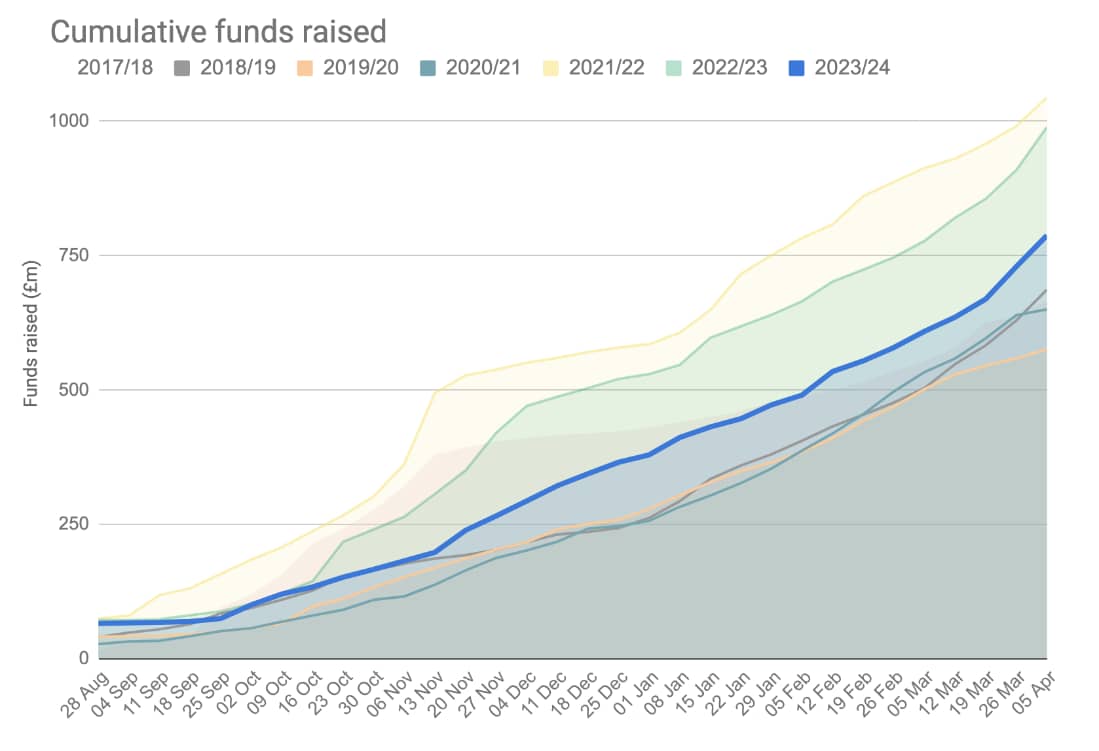

New money invested into Venture Capital Trusts (VCTs) hit £882 million this tax year, around 18% lower than last year according to just published AIC stats.

However, this is still the third highest raise on record, beaten only by the record 2021/22 and 2022/23 tax years.

Alex Davies, founder and CEO of Wealth Club, the UK’s largest VCT broker said, “Despite the economic uncertainty over the last year VCT sales still managed to achieve their third highest tally on record. This was helped by investors who had been sitting on the sidelines for much of the year pouring money in at the last minute as the 5th April deadline drew near.

It’s easy to see why VCTs remain attractive. If you are a wealthier investor, you’re caught between higher taxes and reduced CGT and dividend tax allowances on the one hand and restrictions on where you can invest on the other.

Taxes are at a 70-year high and traditional investments like buy-to-let and pensions have been squeezed. Venture Capital Trusts stand out. They’re simple and highly tax efficient for a start. But it’s not just about saving tax, VCTs are also exciting: you’re backing some of Britain’s youngest and brightest companies and, probably adding something completely different to your portfolio.

New money into VCTs is great news for the British economy: young businesses create a disproportionate amount of jobs and economic growth.”

Wealth Club estimates not including dividend reinvestment

Wealth Club estimates not including dividend reinvestment

What is the outlook for VCTs?

“2024/25 looks set to be a year of uncertainty for UK investors. There will be an election at some point, and taxes look set to continue rising regardless of who wins.

Fortunately, both the main political parties have stated their support for Venture Capital Trusts – seeing them as a key to supporting economic growth and making the most of the UK’s entrepreneurial flair.

With capital gains tax and dividend allowances being cut again, and tax thresholds expected to remain frozen, the tax burden on wealthier individuals will continue to grow. VCTs remain one of the few tax efficient investments available to the highest earners and we expect them to remain very popular as a result.”

Leave a Comment