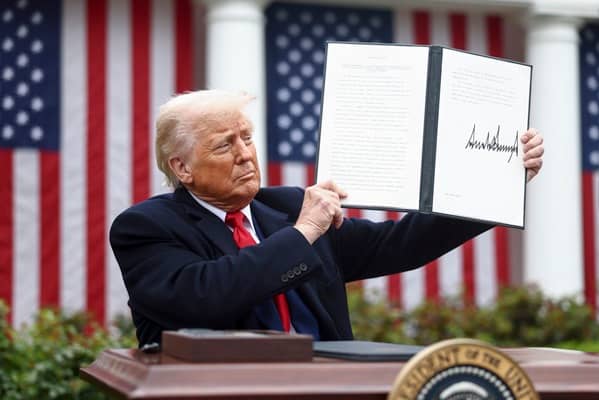

US President Donald Trump’s second term has been marked by sweeping tariffs – ostensibly put in place to protect American manufacturing industries and bolster US jobs. Since day one, tariffs have been a crucial part of Trump’s playbook to reshape global trade relations, imposing what he considers “reciprocal” taxes that can match the tariffs levied on the US by other countries.

During his first day back in office, Trump promised 25% tariffs on imported goods from Mexico and Canada. Since then, a blanket 10% US tariff has hit nearly every American trading partner, with 60 countries facing additional tariffs. The UK, for instance, has been hit with a 10% tariff on all of its goods, which, according to Trump, is a retaliation to the UK tariffs imposed on American products.

Financial experts warn that Trump’s tariffs could threaten global growth and enhance the likelihood of “severe shocks” to the financial system. According to the Bank of England (BOE), Trump’s tariff announcements have led to a “material increase in risks to global growth,” knocking off investor confidence and elevating the risk of a “further sharp correction” in financial markets. BOE’s financial policy committee further warned that major shifts in the predictability of global trade caused by Trump’s tariffs may compromise international cooperation, “which could reduce resilience of financial systems.”

Economists say the full effect of Trump’s tariffs will depend on how other countries respond and how foreign exchange rates are affected. When the US made its wide range of tariff announcements on April 2, some governments responded with retaliatory tariffs, with the European Union proposing a 25% tariff on goods from the US.

Effect on the global economy

According to BOE deputy governor Clare Lombardelli, tariffs could depress economic activity, increase uncertainty, and hit asset prices. However, UK chancellor Rachel Reeves assured the country’s leading banks and asset managers that she was committed to pursuing the best deal with the US.

For some economists, the potential of tariffs contributing to higher inflation may compel central banks to tighten their monetary policy, impacting bonds and borrowing costs. This could affect everything ranging from mortgage rates to corporate investment, potentially slowing down economic growth. “The risk of a US and global recession has increased directly as a result of the US tariffs, as has the likelihood that inflation stays higher for longer. In turn, the possibility of stagflation makes life very difficult for central banks,” global private banking group EFG CIO Daniel Murray has said to The Guardian. A day after Trump’s tariff announcement, UK Prime Minister Keir Starmer told business leaders during a meeting in Downing Street that “there will be an economic impact from the decisions the US has taken.”

According to a City AM / Freshwater Strategy poll, seven in 10 UK voters are worried about the impact of Trump’s tariffs on the British economy, with 16% saying they are ‘very worried’ about the effect of US tariffs on their finances. Trump’s sweeping tariffs have also fueled fears of a potential recession, especially with experts saying that the size of US tariffs has significantly increased the likelihood of a global recession. “If the US does not change its policy stance on tariffs… we would expect a recession to be defined in the next six months,” noted RSM Canada economist Tu Nguyen to CBC News. “I think it’s reasonable to say that we are entering one as we speak.”

Potential for a global recession

Trump’s tariffs are triggering a “very significant negative shock on economic activity,” said European Central Bank governing council member José Luis Escrivá. How will the UK be affected? With the pound weakening significantly against the dollar, imported goods from the US will be more expensive. As a result, Britons may potentially find themselves paying higher prices for basic goods such as transport equipment, machinery, and even vitamins and antibiotics, which are all mainly supplied by the US. Should economic pressures worsen, higher costs could potentially be passed onto UK consumers. “The longer this goes on, the more layoffs will happen, the more factories would just shut down because they can’t operate under the new tariffs’ rules,” Nguyen said.

According to Concordia University economics senior lecturer Moshe Lander, this type of tariff trade war has not been seen in over 100 years. After Trump announced his sweeping tariffs, investment bank JP Morgan projected that there could be a 60% chance of the world economy entering a recession by year-end, up from 40% at the end of March. These economic downturns can ultimately have knock-on effects in the UK. A poll of economists released by the Financial Times suggests that the UK economy is expected to grow by only 0.8% this year, which is lower than the 1.2% expected in January. Economists also predict that as sweeping tariffs continue to make goods pricier and less accessible, more consumers will back out from purchases and investments, which can dampen demand and increase the risk of layoffs.

Car tariffs, in particular, could pose significant problems for the UK. Available data shows that the US is the largest single market by country of the UK’s car sector. It accounted for £6.4 billion worth of car exports in 2023. The Institute for Public Policy and Research also suggests that over 25,000 direct jobs in the UK manufacturing industry alone can face significant risks from the tariffs imposed on car exports by the US. David Miles, an Office for Budget Responsibility member, told The Guardian that US tariffs at 20% or 25% maintained for five years in the UK would “knock out all the headroom the government currently has.”

The National Institute of Economic and Social Research forecasts lower economic growth caused by higher global interest rates. Estimates show that the UK’s gross domestic product – which measures everything produced within the economy – could be 2.5% to 3% lower over five years and 0.7% lower in 2025. “Clearly, there will be an economic impact from the decisions the US has taken, both here and globally,” Starmer has said.

Trump’s tariffs have negatively impacted global stock markets, but could this lead to a potential global recession? Experts say that what happens in the stock market does not always reflect what will happen in the economy. In other words, decreasing share prices do not always mean economic downturns. The bad news is that sometimes they do. Major falls in stock market prices, similar to what happened after the sweeping tariff announcements, would mean a major reassessment of future profits of businesses that are part of global stock markets.

With Trump’s tariffs in play, markets expect costs to rise and profits to fall. Although this does not automatically mean a recession will follow, experts point out that the chances are much higher than they were before the Trump administration announced the most wide-ranging tariffs seen in over a century. But how do we know if we’re already in a recession?

A recession happens when a country’s GDP experiences two successive quarters of significant losses. Between October and December last year, the UK’s economy grew by merely 0.1%, with the latest data showing that it shrank by the same amount in January. Experts say it is still too early to tell if we have already hit a recession, and it is unlikely that we will experience major synchronised economic downturns now. However, economic analysts warn that it should not be taken out of the equation, as the chances of a recession in the US, UK, and European Union have significantly increased.

With inflation on the rise and experts warning of a potential global recession due to tariffs, what measures can be taken to preserve asset value and hedge against financial risks? According to Maxim Manturov, Head of Investment Advice at Freedom Finance Europe, investors can diversify their portfolios by exploring diverse investment options that perform well despite rising prices. Consumers can choose instruments or investments that have the potential to generate returns and exceed or maintain inflation levels. Examples of instruments considered safer areas of investment include ETFs, energy stocks, commodities, and the gold market.

According to experts, it’s crucial to remember that stocks will always outpace inflation in the long term, so investing in assets that can yield returns above inflation is essential. Market experts typically recommend investing in diversified index funds hinged on broader market indices instead of holding cold cash. Doing so helps diversify your portfolio and minimise the risk of losses. For instance, consumers can invest in commodities such as electricity, grains, oil, natural gas, and precious metals. The prices and asset values of products used to produce commodities increase along with the rising prices of the commodities themselves, making them a reliable option for anyone seeking safer investments. Although this is a good practice for beating inflation, experts also note that investing in safe assets may not guarantee a complete solution to combat the effects of a recession since some assets could still decline during such circumstances.

With experts saying that a global recession is likely, one important question stands: Are UK banks prepared for it? According to the BOE, the UK banking system has remained resilient, with financial markets continuing to operate in an orderly fashion. But what exactly are UK banks doing to weather a possible recession?

Measures and frameworks to counter a potential recession

According to experts, banks play a crucial role during economic downturns. These institutions act as a haven for financial assets and credit, which are vital in helping businesses and individuals maintain operations or recover from a recession. Banks also play an essential part in maintaining stability in the financial system by efficiently allocating resources and managing financial risks.

UK banks have adopted several risk-management frameworks designed to manage and weather financial risks, which could help mitigate the effects of a potential global recession. Particularly, UK banks are subject to the International Financial Reporting Standard 9 (IFRS 9). Developed in response to the global financial crisis, the IFRS 9 provides timely recognition of loan losses and a forward-looking impairment model. Banks can make use of tools that provide a solid framework for managing transactions, IFRS calculations, accounting generation, and processing of disclosures. Banking institutions can also leverage end-to-end treatment of expected credit loss (ECL) by developing an ECL model that can be run in multiple scenarios and using ECL calculators that can work with macroeconomic scenarios.

IFRS 9’s ECL model has replaced the previous ‘incurred credit loss model,’ which did not consider the effects of possible future credit loss events. The main goal of IFRS 9’s requirements is to provide valuable information about ECLs, as the Accounting Standard requires institutions to recognise and update these losses throughout a financial asset’s life. These disclosures play a vital role in informing investors about anticipated credit losses.

The IFRS 9’s ECL model allows for early loss recognition, helping banks anticipate future losses before they even materialise and enabling them to prepare by building up buffers. With UK banks adhering to IFRS 9 requirements, they can efficiently recognise ECLs and identify potential losses to help them strengthen their balance sheets and loaning capacity during a recession. Early recognition of ECLs allows banks to act proactively and create provisions that can absorb potential losses caused by a recession, making them more resilient to economic shocks.

The IFRS 9 serves as a replacement for the International Accounting Standards 39 (IAS 39). Under IAS 39’s incurred credit loss model, impairment losses can only be recognised if there is clear evidence that these losses already occurred, which is why experts considered this model as “too little, too late.” Meanwhile, IFRS 9 provides a forward-looking methodology by identifying the losses that have already been incurred and the expected future credit losses through a three-stage approach. This early recognition enables banks to make preparations for a potential recession.

Studies have shown that the ECL approach adopted by IFRS 9 results in a higher accounting quality for all firms, highlighting its capacity to enhance market discipline through increased transparency and early loss recognition. Research also shows that the ECL model used under IFRS 9 provided better mechanisms in anticipating loan loss provisions than the incurred credit loss score model of IAS 39, highlighting how the former framework is better and more efficient in anticipating overall banking risks.

Aside from adhering to risk-management frameworks like the IFRS 9, banks may also cut interest rates to help mitigate the effects of a global recession. “It’s not unthinkable that we will actually see interest rates come down more rapidly than expected. Of course, any serious hit to UK economic growth could be felt in the jobs market, not just in terms of job insecurity but also in that firms suffering uncertainty — as well as the tax rises already in effect —could restrict wage and salary growth,” said Evelyn Partners managing director Jason Hollands in an interview with Yahoo Finance UK. Early this month, investors increased their bets on interest rate cuts by major central banks to prevent the repercussions of a possible global recession. Investors are expressing their expectations for a rate cut by the BOE as concerns over the economic consequences of Trump’s tariffs continue to grow.

By allowing interest rate cuts, banks can make it cheaper for businesses and consumers to borrow money, stimulating spending and investment to boost economic activity during a recession. The UK’s interest rates currently sit at 4.5%, and the central bank has become wary of further cuts, with increasing global trade uncertainty being a significant factor why it refrained from cutting interest rates in March. According to investment analyst Dan Coatsworth, “a pause in rate cuts is bad news for companies and consumers who are under financial pressure and struggling to pay off their debts. It is also bad news for anyone looking to get on the housing ladder and hoping mortgage rates would come down soon.”

While nothing is certain yet, financial markets predict that the BOE may be compelled to cut interest rates in May to stimulate economic growth. “The BOE needs to balance its price stability objectives — with the BOE expecting inflation to accelerate in coming quarters — against the need to support the UK economy from the significant shock imposed by Trump’s ‘reciprocal’ tariffs,” said Morningstar economist Grant Slade.

Meanwhile, the BOE launched the 2025 bank capital stress test earlier this year. The test, which includes the participation of seven of Britain’s largest and most systemic banks, assesses if banking institutions have enough capital to manage theoretical economic shocks. According to the BOE, it involves a “hypothetical stress scenario which will be used to assess the resilience of the UK banking system to deep simultaneous recessions in the UK and global economies, large falls in asset prices, higher global interest rates, and a stressed level of misconduct costs.” The participating banks and building societies are Barclays, HSBC, Lloyds Banking Group, Nationwide, NatWest Group, Santander UK, and Standard Chartered. These institutions represent 75% of lending to the real economy. With measures such as this, UK banks can be better equipped to mitigate the risks of future economic downturns.

With Trump’s tariffs causing economic uncertainty, preparation is more crucial than ever. UK banks and other financial institutions will play a key role in mitigating the consequences of a global recession as long as they have the right tools and preparations.

Leave a Comment