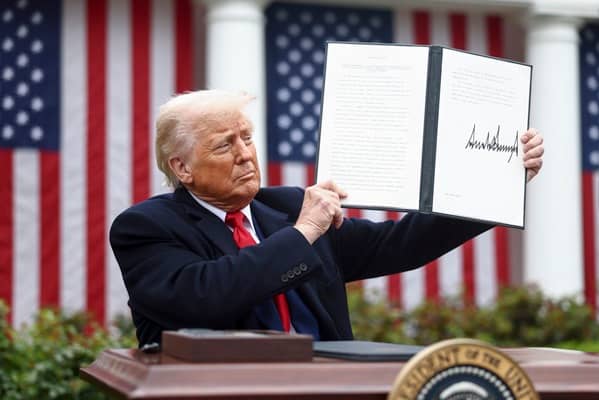

Following Trump’s “Liberation Day” speech delivered in the Rose Garden this afternoon, where a 10% tariff on the UK was announced (compared to 20% on the European Union),

Newspage asked economists, investment and forex experts for their views on the potential impact on the UK economy and Sterling.

Business owners from all sectors were also asked for their views on how the tariffs announced by Trump might impact them and their sectors.

One economist said: “This was an unbelievably surreal announcement, with Trump reading tariff levels like a cruise-ship bingo caller to a garden full of sycophants.

“He said it’s all ‘very simple’ for the US but, sadly, this is not the case for those on the receiving end of his tariff tempest. For Britain, this tariff battle could be the start of a Brexit dividend, with the UK expecting 10% tariffs, one of the lowest globally, compared to the EU at 20%.”

“A forex expert added: “A 10% hit could shave roughly 0.5-1% off GDP, depending on how much trade gets choked.” Views below.

Gabriel McKeown, Head of Macroeconomics at Sad Rabbit said, “This was an unbelievably surreal announcement, with Trump reading tariff levels like a cruise-ship bingo caller to a garden full of sycophants.

“He said it’s all ‘very simple’ for the US but, sadly, this is not the case for those on the receiving end of his tariff tempest.

“For Britain, this tariff battle could be the start of a Brexit dividend, with the UK expecting 10% tariffs, one of the lowest globally, compared to the EU at 20%.

“With European exports, already suffering from sluggish growth, in the firing line, a further weakened euro could push the ECB into a defensive stance, delaying interest rate cuts or even triggering unexpected interventions in an effort to stabilise the currency.

“For Britain, with both the US and EU engaged in a tit-for-tat trade war, the UK could further its already fairly favourable position into more of a neutral trading partner, leveraging its free trade agreements to fill supply chain gaps as a stable intermediary.”

Tony Redondo, Founder at Cosmos Currency Exchange added, “Trump’s “Liberation Day” speech is promising what he calls “the Golden Age of America,” which he believes will see more jobs and domestic production ushering in a new age of domestic prosperity.

“In a detailed presentation, Trump announced a 10% tariff on the UK and a heftier 20% on the EU among some even bigger tariff charges across the globe. For the UK economy, that 10% tariff stings as the US is Britain’s biggest single export market. A 10% hit could shave roughly 0.5-1% off GDP, depending on how much trade gets choked.

“The UK’s Q4 2024 GDP growth was a measly 0.1% so this could tip it into the red. The Euro’s taking a bigger punch with a 20% tariff that could kneecap growth in the likes of Germany, Ireland, and Italy, with their US surpluses in the direct line of fire.

“The reaction in the currency markets has been muted so far. The devil is always in the details so expect more volatility once the numbers are crunched.”

Harry Mills, Director at Oku Markets said, “It is undeniable: whether you like him or not, Donald Trump is an incredible communicator. We received the per-country tariff news courtesy of Trump’s large ‘tariff board’ stage prop, confirming reciprocal tariffs of about half the level the administration claims is levied on US products.

“Trump explained this was the US “being nice”. My initial thought was this erred on the lighter side of what was possible from today’s event, but some of the tariffs are more than sizeable.

“10% is the minimum, with the UK, Australia, and Singapore seemingly getting off lightly when compared to 34% on China, 24% on Japan, and 20% on the EU! In the short term, this news may continue to weigh on the dollar, with sterling likely to outperform the euro.”

Leave a Comment