The financial market landscape is tumultuous yet it’s an arena where volatility and opportunity intersect. Amid this chaos, one trend has continued to stand out: the staggering rise of Artificial Intelligence (AI) stocks.

As investors wage their bets and attempt to capitalize on this technological revolution, one stock in particular is emerging as a stable and profitable option — the Global X Artificial Intelligence and Technology ETF (NASDAQ: AIQ).

Key Takeaways

- Strength in Numbers: While individual stock selection comes with obvious challenges, the Global X Artificial Intelligence and Technology ETF offers an interesting solution, providing investors with diversified exposure to a curated selection of top-performing AI companies.

- Robust Portfolio: With a portfolio of 84 stocks, including industry front runners like Nvidia, Meta Platforms, Amazon, and Oracle, the AIQ ETF offers investors unparalleled access to the transformative potential of AI technologies.

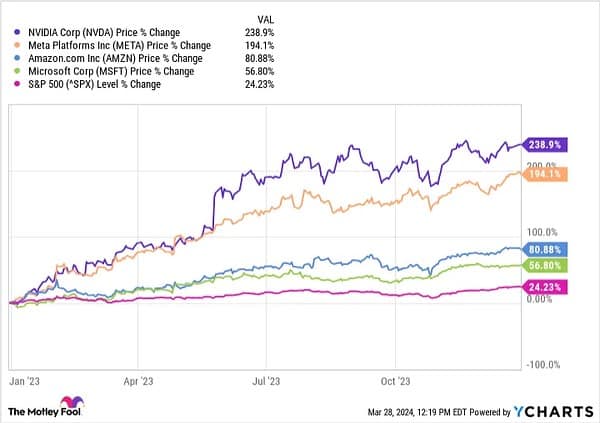

- Market-Beating Returns: Surpassing not only the S&P 500 but also its peers in the ETF space, AIQ stands as a testament to the allure and promise of AI investments.

Global X Artificial Intelligence and Technology invests in companies that stand to benefit from AI and the hardware providers that underpin its development. It holds 84 stocks, but its top 10 positions account for 33% of the total value of its portfolio.

Its top 10 include (Stock, portfolio weighting):

- Nvidia– 4.23%

- Meta Platforms – 3.6%

- Netflix – 3.5%

- Amazon – 3.24%

- Oracle – 3.14%

- Tencent Holdings – 3.12%

- Qualcomm – 3.09%

- IBM – 3.08%

- Salesforce – 3.06%

- Broadcom – 3.02%

Data source: Global X. Portfolio weightings are accurate as of March 27, 2024, and are subject to change.

Chelsea Alves, a consultant with UNMiss, said, “Despite the undeniable potential of AI stocks, it’s crucial to consider the inherent risks associated with concentrated ETFs.

“As such, investors should exercise caution and maintain a balanced approach to portfolio management. While the prospects for AI remain promising, diversification remains key to mitigate downside risk and safeguard long-term investment objectives.”

As Wall Street forecasts substantial growth for the AI industry, with estimates ranging from $7 trillion to $200 trillion in added economic value, the Global X Artificial Intelligence and Technology ETF emerges as a considerable investment opportunity for forward-thinking investors.

With its diversified approach and track record of outperformance, AIQ stands poised to deliver the returns investors seek in the years to come. AI is on an upward trajectory with no cap in sight and now is the time to act before it becomes more saturated.

Leave a Comment