In light of the government’s recent announcement that national insurance rates are set to rise, many of us will be seeing a little extra taken from our pocket. But with this new increase, how much will it really cost you?

In order to find out, the Golf Travel Centre decided to break down how much these tax changes will set you back, and what it would cost you in nights out, takeaways, luxury goods and holidays.

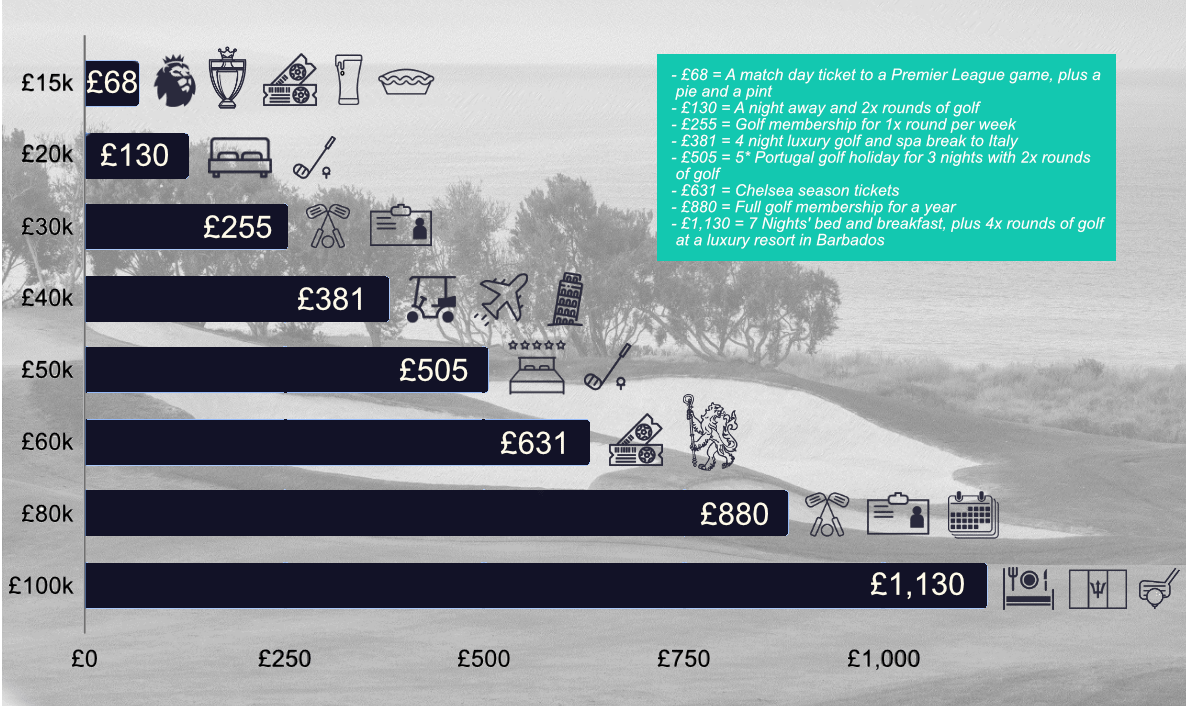

Depending on the tax bracket you’re in, the additional tax you’ll have to pay will vary:

So, how much more will you have to pay?

| 68 |

| 130 |

| 255 |

| 381 |

| 505 |

| 631 |

| 880 |

| 1,130 |

Earners making 15k will be taxed £68 a year, equating to a matchday ticket to a Premier League game, 1 night out,or a full body massage.

For those earning £20,000, the additional tax will cost you £130 a year. All in all, this is equivalent to a 3 month gym membership, 1 Night, 2 Rounds at a luxury hotel in the UK, or afternoon tea for two at Fortnum and Mason.

Tax payers in the £30,000 bracket will be taxed an additional £255, allowing you to play golf once a month at a club, purchase one first-class Eurostar ticket, or buy a month’s worth of food shop and eat out for one person.

Those making £40,000 will be set back £381 pounds a year – equivalent to an Aston Villa season ticket, 5 nights out, 4 night luxury golf & spa break to Italy, or a Dyson hair dryer.

For those making £50,000, an additional £631 will be owed in taxes, equating to a 3-month Equinox membership, flights from London to New York, and a month’s worth of food for a family of four.

The £60,000 earners will owe £880 extra in taxes, an amount equal to dining out at your favourite restaurants at least three times a month, 3 nights in Costa De La Luz, Spain, or purchasing an iPad Pro.

Individuals earning in the highest tax bracket will see the largest increase, with a hefty £1,130 added to their tax bill. For this price tag, individuals would have been able to purchase Arsenal season tickets, a 3 night stay in a 5-star hotel in the Algarve, or an iPhone 12.

For golfers and sports enthusiasts alike, here’s how the increases look in relation to the cost of your favourite activities and holidays:

Leave a Comment