Ford Motor Company has announced a reduction in its earnings forecast 2024 despite reporting results that exceeded Wall Street expectations for the third quarter.

The company posted earnings of $0.49 per share on revenue of $46.2 billion, surpassing analysts’ projections, which anticipated $0.47 per share and $45.32 billion in revenue.

However, this news did not support the stock price, which fell over 5.8% in after-hours trading.

The downward adjustment in the earnings forecast reflects a shift in Ford’s strategy for electric vehicles, a segment in which the company has heavily invested in recent years.

2024, Ford expects an adjusted EBIT of $10 billion, at the lower end of its previously projected range of $10 billion to $12 billion. This $1 billion reduction in the forecast is primarily due to adjustments in its investment strategy for its electric vehicle lineup.

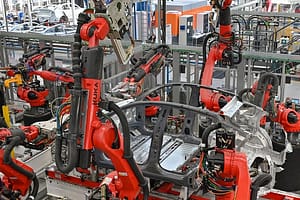

The third-quarter results highlight a strong performance in Ford’s traditional internal combustion vehicle business, while the electric vehicle segment remains challenging. Ford has focused on cost reduction and improving production efficiency, yet the electric segment continues to generate significant expenses that have impacted overall profitability. This mixed strategy responds to the evolving automotive market, which faces intense competition and increasingly strict emission regulations.

On the other hand, the decline in the stock price can be interpreted as a sign of investor skepticism about Ford’s ability to transform its business around electric vehicles. Although sales in this segment have grown, profit margins remain low. Additionally, Ford faces aggressive competition from other manufacturers, such as Tesla and General Motors, who are ramping up their electrification investments.

Ford is evaluating strategies to better adapt to this changing environment. The company has committed to optimizing production, reducing costs, and accelerating innovation in its electric line, positioning itself as a leader in electric mobility without sacrificing long-term profitability.

In conclusion, the reduced earnings forecast 2024 underscores Ford’s challenges in its transition toward electrification. While its third-quarter results exceeded expectations, the market remains uncertain about its ability to establish itself in the electric vehicle segment and improve its margins. Ford will need to carefully balance its expansion efforts in this emerging market while preserving the profitability of its traditional business to satisfy its shareholders and investors.

Leave a Comment