The UK stock market has yet again tumbled as Donald Trump’s tariffs come into effect with a 10% levy on UK goods being imported into America.

Chinese goods entering the US are subjected to 104% tariff which came into effect from midnight Washington time.

The FTSE 100 Index fell 2.34%, the FTSE 250 lost almost 2% the pan-European STOXX 600 dropped 2.5%, the French Cac 40 tumbled 2.3%, the Spanish IBEX 35 opened at 2% down.

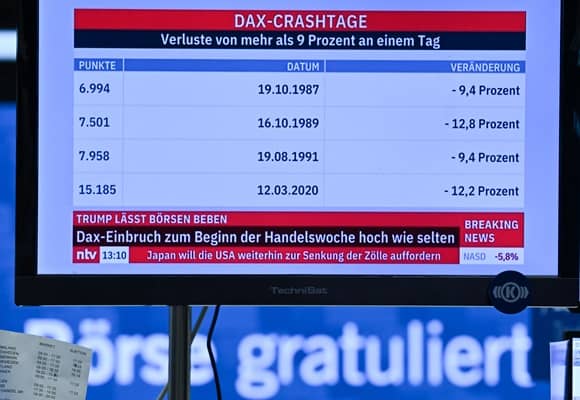

Germany’s Dax fell 2.1% and Berlin has concerns there could be another recession amid the US President’s tariffs war.

The German Finance Minister Joerg Kuki told broadcaster Deutschlandfunk on Wednesday morning, “A possible trade conflict increases the risk of recession, there is no question about that.”

European stock took large hits as the 20% US tariffs started on Wednesday morning.

Chancellor Rachel Reeves said the UK is “accelerating trade deals with the rest of the world.”

The Chancellor will meet with her Indian counterpart, Nirmala Sitharaman with the Trade Secretary Jonathan Reynolds to secure a deal.

The Chancellor said, “In a changing world, this Government is accelerating trade deals with the rest of the world to back British business and provide the security working people deserve.

“We are going further, faster to create the best possible conditions for British business by working to reduce barriers to trade.”

Leave a Comment