The US ETF market isn’t exactly having a great 2024. The talks regarding interest rate adjustments, courtesy of the dovish stance, should have been good news for the ETF space.

However, with the US10Y — 10-year treasury yield surging — the market seems to be thinking that the rate cut talks might not materialize, taking the steam out of the stock baskets.

The choppy start to the ETFs in 2024 is the worst the space has seen since 2002, despite the industry coming with 13 new products. Rahul Nambiampurath, a Stockoptionscalculator.com analyst, believes that the correction in the ETF space is more of a repricing event, happening in the wake of expected rate cut reassessments concerning the Federal Reserve.

“The decline in ETF valuations shows the lack of new buyers, hinting at a broad-based move away from riskier assets,” Rahul mentions.

Diving deep into the ETF space: Decoding the numbers

Several notable ETFs have been underperformers right at the start of 2024. Henry Hub Natural Gas Futures 2024 saw a drop of 7.84% year-to-date, as of Jan 7, 2024, whereas Cboe S&P 500 Annual Buffer Protect 2024 ETF dipped 6.97%.

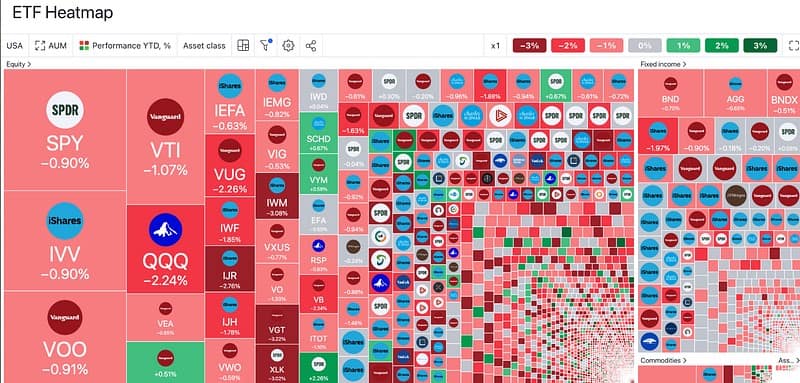

Looking at the ETF heatmap, most of the names are in red, indicating a shift in investor perception. One reason for the broader ETF underperformance could be the lowest since 2020 VIX levels. As VIX indicates volatility and fear, lower levels might mean investor portfolio reassessment and a trend where they start selling off riskier assets.

Looking at the ETF heatmap, most of the names are in red, indicating a shift in investor perception. One reason for the broader ETF underperformance could be the lowest since 2020 VIX levels. As VIX indicates volatility and fear, lower levels might mean investor portfolio reassessment and a trend where they start selling off riskier assets.

Notably, the VIX S&P 500, as of Jan. 8, 2024, is at 13.79, which is close to the lows made in 2020. It has been close to four years since the volatility is this low, showing that 2024 could be the year of safer assets like bonds.

Is it all underperformance for the ETFs?

2024 is still young. And the quick YTD underperformance shouldn’t be deemed absolute. However, the declines do reveal something interesting. First, let us track the crucial drops in 2024:

- MAC Global Solar Energy dipped by 8.61%, YTD

- Nasdaq Clean Edge Green Energy dipped by 7.90%, YTD

- Fidelity Electric Vehicles and Future Transportation ESG Tilted nosedived by 7.63%

These declines might indicate a shift from the growth-focused innovative spaces.

Now, let us track the ETFs that were in the green as of early 2024:

- S&P 500 Capped 35/20 Utilities grew 2.98%

- S&P Capped 35/20 Healthcare grew 3.33%

The outperformance of the above-mentioned ETFs shows that investors might still be interested in traditionally stable and conservative spaces like healthcare and utilities, especially at a time when uncertainty is all around.

Leave a Comment