Don’t panic, hold your nerve and you will be rewarded – top economists tip to Brits looking on as Trump tariffs cause stock market meltdown

Jacob Falkencrone, Global Head of Investment Strategy at investment platform Saxo, said, “Panic is the enemy but patience will see big rewards and volatility is the chance to buy quality cheap.

“Trump is playing high-stakes poker hoping the world will fold, but inflation is the slow leak to be aware of so don’t panic – the market crash could lead to big rewards if you hold your nerve.”

It’s natural to feel concerned during dramatic market swings, but panic is rarely beneficial. Historical data clearly demonstrates markets inevitably recover from downturns.

If retirement is far off, market dips can even become valuable opportunities. However, if you have shorter-term cash needs, you might consider slight defensive adjustments.

Historical context helps. Most bear markets have historically recovered fully within two years, and often even sooner. It’s uncomfortable now, but history strongly favours patient investors who remain disciplined.

Resist panic-selling. It’s typically not a good idea, as it typically locks in losses permanently. Instead, consider whether selective buying makes sense. Buying stocks in high-quality companies at discounted prices during market sell-offs can reward patient investors significantly over the long run.

After the 2008 financial crisis and the COVID-19 market crash, stock prices rebounded strongly, rewarding those who stayed invested and calm. Disciplined investors who stayed invested through volatility typically saw significant returns during recovery periods. So historically speaking, staying patient typically yields far greater rewards than attempting to time the market.

Looking back, every major downturn has eventually been followed by significant recoveries—patience pays handsomely in investing.

Volatility is a great chance to buy quality

Volatility presents exceptional opportunities to enter quality stocks and ETFs at discounted valuations. Consider sectors that are typically resilient—such as healthcare, consumer staples, and utilities. Additionally, broad-based ETFs such as the MSCI AC World for immediate diversification and reduced risk during uncertainty.

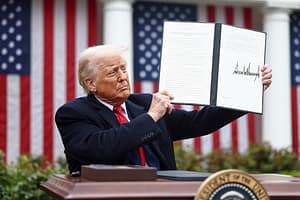

Trump is playing high-stakes poker – he is betting big on other countries folding

In a sense, Trump is playing high-stakes poker—betting big to force others into folding, but risking enormous consequences if things go wrong.

His tariffs are intended to push other nations into more favourable trading arrangements, protect domestic industries, and reduce trade deficits. Critics argue this is a dangerous gamble with the global economy at stake—potentially harming long-term growth to achieve short-term political objectives.

Inflation is a slow leak – shield yourself from its impact

Tariffs directly increase consumer prices. Current projections suggest tariffs could raise inflation notably, eroding consumer purchasing power. Including inflation-hedged investments such as inflation-linked bonds in your portfolio can help shield you from these pressures. Inflation is like a slow leak: unnoticed at first, but dangerous if left unattended.

Leave a Comment