London’s automotive aftermarket is witnessing a remarkable shift as traditional family-run car parts dealers embrace digital transformation to capture new markets and serve evolving customer needs. These established businesses, many operating for decades, are successfully combining their deep industry knowledge with modern e-commerce platforms to achieve impressive growth in wear parts sales.

Sources: see below

The digital revolution hits motor row

Traditional motor factors across London have discovered that digital channels offer unprecedented opportunities to expand their customer base beyond local garages and trade customers. Family businesses like Stockwell Motor Accessories, which has been serving the South London community since 1957, exemplify this transformation. These dealers are leveraging sophisticated e-commerce platforms to reach younger demographics who prefer researching and purchasing automotive parts online.

The shift represents more than simply moving catalogs online. Smart inventory management systems now predict demand patterns for high-turnover items like brake pads, filters, and spark plugs. Data analytics help dealers identify which parts move fastest in different seasons and adjust stock levels accordingly.

Brake components leading the growth

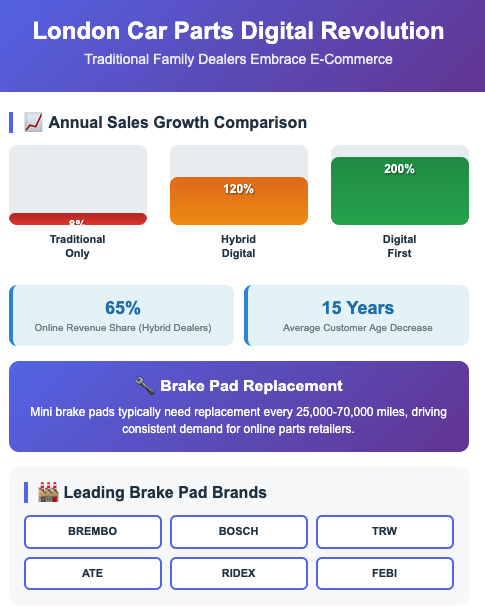

Wear parts, particularly brake components, have emerged as key drivers of online sales growth. The automotive braking market offers steady demand as brake pads require regular replacement across all vehicle types. Mini brake pads according to buycarparts.co.uk, typically need to be replaced every 25,000 to 70,000 miles, depending on driving conditions and pad material.

Leading brake pad manufacturers have capitalized on this digital shift. Brembo, renowned for high-performance applications, offers premium ceramic and semi-metallic compounds that appeal to performance car enthusiasts shopping online. Bosch, as one of Europe’s largest automotive suppliers, provides reliable mid-range options suitable for most passenger vehicles. TRW (now part of ZF) delivers excellent value propositions for cost-conscious customers, while ATE focuses on original equipment quality replacements. Ridex and Febi round out the popular brands, offering comprehensive coverage for European vehicles at competitive prices. These manufacturers have adapted their distribution strategies to support both traditional trade channels and direct online sales.

According to AUTODOC Blog, “Brake pads resistant to temperature of 300-350 ° C should be sufficient for city driving and a moderately fast ride. Sports cars are equipped with brake pads that operate at a temperature of 900 °C, but they ensure an effective braking only when heated above 100 °C.”

Technology driving transformation

Modern automotive e-commerce platforms integrate sophisticated fitment databases that allow customers to search by vehicle registration number or specific make, model, and year combinations. These systems dramatically reduce ordering errors and improve customer satisfaction. Real-time inventory tracking ensures accurate availability information, while integration with multiple suppliers enables automatic reordering of fast-moving items.

London dealers have embraced mobile-optimized websites and smartphone applications that cater to younger technicians and DIY enthusiasts. These platforms typically feature detailed product specifications, fitment guides, and installation videos that help customers make informed purchasing decisions.

Market performance and growth metrics

| Business Type | Average Sales Growth | Online Revenue Share | Customer Age Shift |

| Traditional Dealers Only | 5-8% annually | 15-25% | Limited change |

| Hybrid Digital Operations | 85-120% annually | 45-65% | 15 years younger average |

| Digital-First Businesses | 150-200% annually | 80-95% | Predominantly under 40 |

The data reveals striking differences between businesses that have embraced digital transformation and those maintaining traditional operations. Hybrid operations, combining physical locations with robust online presence, achieve the strongest sustainable growth while maintaining established trade relationships.

Customer behaviour evolution

London’s automotive repair sector serves diverse markets, from independent garages in industrial estates to mobile mechanics operating across the capital. Digital platforms enable these professionals to compare prices instantly, check stock availability across multiple suppliers, and arrange convenient delivery or collection options.

Younger mechanics increasingly expect seamless digital experiences similar to consumer retail platforms. They value detailed product information, customer reviews, and educational content that helps them understand applications and installation procedures. Traditional dealers who invest in creating comprehensive online resources often see significant improvements in customer loyalty and order frequency.

Supply chain optimisation

Data-driven inventory management has revolutionized how traditional dealers stock popular wear items. Predictive analytics identify seasonal patterns, helping businesses prepare for peak demand periods like MOT season when brake pad sales typically surge. Automated reordering systems maintain optimal stock levels while reducing working capital requirements.

Integration with multiple suppliers enables dealers to offer broader product ranges without physical storage constraints. Drop-shipping arrangements for slower-moving items complement fast-moving stock held locally, providing customers comprehensive choice while maintaining competitive pricing.

Competitive landscape changes

The digital transformation has intensified competition but also created new opportunities for differentiation. Traditional dealers leverage their local market knowledge and established relationships to provide personalized service that purely online retailers struggle to match. Many offer hybrid services combining online ordering with technical support from experienced counter staff.

Regional delivery networks provide significant advantages over national competitors for urgent orders. Local dealers often provide same-day or next-morning delivery within London, crucial for commercial customers minimizing vehicle downtime.

Future growth strategies

Successful London dealers continue investing in technology infrastructure to support further growth. Customer relationship management systems track purchasing patterns and enable targeted marketing campaigns. Integration with workshop management systems streamlines ordering processes for trade customers.

Mobile applications increasingly incorporate augmented reality features that help identify parts through smartphone cameras. These innovations reduce ordering errors and improve customer experience, particularly valuable for complex brake system components where precise fitment is crucial.

Conclusion

London’s traditional car parts dealers demonstrate that established businesses can successfully adapt to digital markets while maintaining their core strengths. By combining decades of automotive expertise with modern e-commerce capabilities, these family businesses are not merely surviving the digital disruption – they are thriving and capturing new growth opportunities that were previously impossible to access.

The transformation extends beyond simple online sales to encompass sophisticated data analytics, customer relationship management, and supply chain optimization. These investments position traditional dealers to compete effectively against both established national chains and emerging digital-only competitors while serving their local communities more comprehensively than ever before.

Sources for Infographic DataPrimary Research Sources:

Market Data Sources:

Virto Commerce – Automotive e-commerce solution performance metrics |

Get real time update about this post category directly on your device, subscribe now.

Leave a Comment